Sonic Price Accumulation Signals Imminent Rally as Derivatives Shorts Stack Up

Sonic's building momentum while shorts pile on—classic setup for a violent squeeze.

Price action consolidates near key support levels as derivatives traders increase bearish bets. Retail panic meets institutional accumulation—we've seen this movie before.

Short interest hits multi-week highs across major exchanges. Funding rates turn negative while open interest spikes. Textbook contrarian signal flashing bright green.

Market makers positioning for volatility expansion. Liquidity pools thinning beneath current levels—any upside break could trigger cascading liquidations.

Remember: markets tend to hurt the maximum number of participants. When everyone's betting on red, the wheel often stops on black. Just ask those 2021 GameStop shorts how crowded trades work out.

Sonic price key technical points

- Value Area Support: Price consolidating near $0.30 within a high-volume region.

- Resistance at $0.40: Key upside target if accumulation leads to rotation higher.

- Short Squeeze Potential: Increasing short positions could fuel a rapid rally.

Sonic Token has been trading around its value area low, with strong confluence at support levels including the point of control. Price has held this region for a considerable time, generating steady volume without breaking down to the lower support NEAR $0.28. This prolonged defense signals accumulation, with buyers actively preventing deeper declines. The current consolidation points to accumulation, with $0.35 and $0.40 emerging as key resistance targets.

If Sonic can sustain this region and begin closing candles above $0.30, the setup becomes more bullish. Such a breakout WOULD confirm continuation of the higher-low structure and strengthen the case for a move toward resistance at $0.40. This would also reinforce the prevailing bullish market structure, suggesting that the correction phase is ending and upside expansion could be underway.

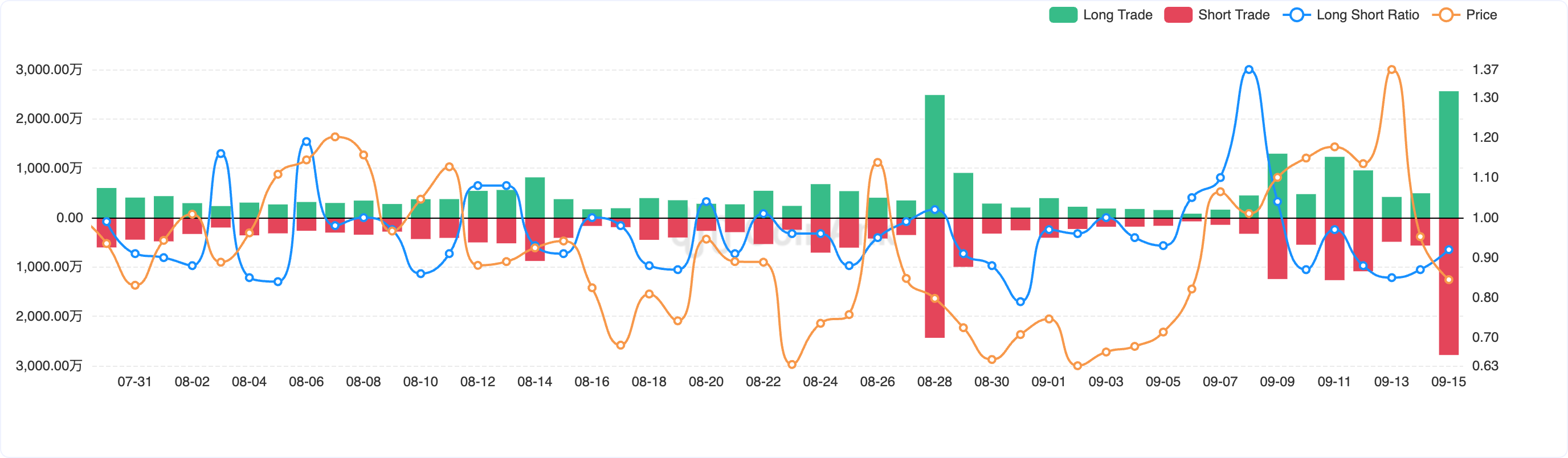

Another key factor supporting this outlook is the increase in short positions across derivatives markets. Over recent days, Sonic Token has seen a higher ratio of shorts opening compared to longs. While this initially signals bearish sentiment, it also creates the conditions for a potential short squeeze.

If price begins to rally from support, shorts may be forced to cover their positions, adding fuel to the upside move. This dynamic often accelerates rallies, particularly when coupled with strong accumulation and support defense. While the squeeze has not been triggered yet, the magnitude of short positioning makes it a scenario worth monitoring closely.

The volume profile shows strong activity at current levels, reinforcing the idea that accumulation is underway. For the bullish case to materialize, volume inflows must continue supporting upward momentum. As long as Sonic maintains this base, the probability of rotation toward $0.40 remains high.

What to expect in the coming price action

Sonic Token is consolidating in a high-volume region that favors accumulation. If price holds above $0.30 and volume inflows persist, a rally toward $0.40 resistance is likely. With shorts piling in, the potential for a short squeeze could amplify upside momentum, making this an important level to watch for traders.