Could This Single Dividend King Actually Make Your Portfolio Worth $1 Million in 20 Years?

Forget Wall Street's tired advice—this dividend aristocrat might just be your ticket to seven-figure wealth.

The Million-Dollar Blueprint

One stock. Two decades. Seven zeros. The math works—if you pick the right cash-generating machine and let compounding do its magic.

Dividend Royalty in Action

Companies that raise payouts for 50+ straight years don't just survive market cycles—they dominate them. We're talking cash flow factories that print money through recessions, inflation, and whatever crisis CNBC is screaming about today.

The Compound Effect

Reinvested dividends buying more shares buying more dividends—it's the wealth-creation flywheel Wall Street hopes you'll ignore while they push high-fee ETFs.

Risk Versus Reward

No stock guarantees millionaire status—but betting against companies that have paid rising dividends since Nixon was president? That's a special kind of financial arrogance.

Because let's be real—if traditional finance worked, we wouldn't need dividend kings to save us from their 1% savings accounts.

Opportunities for growth

One of the key advantages of Johnson & Johnson's business is that its products consistently remain in high demand. That won't change in the next 20 years -- quite the opposite, actually. According to some estimates, 22% of the world's population will be 60 or older by 2050, compared to just 12% as of 2015. This will result in a higher demand for the pharmaceutical products and medical devices that J&J markets.

Of course, these long-term trends only tell us that the healthcare industry will grow substantially, not that any specific company will do so. However, we have good reasons to believe that Johnson & Johnson will ride this tailwind. Here are three of them.

Image source: Getty Images.

First, the company has a terrific track record of innovation. It has been in business for over 100 years and, throughout its history, has consistently developed and marketed newer and better products while overcoming competition, patent cliffs, economic recessions, pandemics, and many other headwinds. Of course, the future doesn't have to look like the past, but the fact that Johnson & Johnson has done it before should, at the very least, make investors cautiously confident that it can again.

Second, we can look at the current state of J&J's business. The company's lineup is deep, featuring well over 20 brands and more than 10 blockbuster products in its pharmaceutical segment. It's also quite diversified, with medicines spanning infectious diseases, oncology, immunology, neuroscience, and more. Johnson & Johnson also boasts over 100 active programs in its pipeline. Additionally, the company's medtech unit is highly diversified and profitable.

Third, several of Johnson & Johnson's ongoing projects could pay off rich dividends in the next 20 years. Perhaps the best example is the company's work in developing a robotic-assisted surgery (RAS) device, the Ottava. The RAS market is underpenetrated even within the current pool of eligible surgeries. When we consider that there will be higher demand for procedures performed robotically in the future, due to the world's aging population, the opportunities look even more attractive.

Johnson & Johnson is testing the Ottava in the U.S. The device could earn clearance in the country within three to five years, and be an important growth driver for the next 20 years.

Can Johnson & Johnson overcome its headwinds?

Johnson & Johnson faces thousands of lawsuits from plaintiffs who claim that some of its talc-based products gave them cancer. The company has tried -- so far, in vain -- to settle these.

Another threat the drugmaker faces concerns regulatory changes in the U.S. that granted the government more power to negotiate the prices of certain medicines. Some of J&J's products have already been targeted. Perhaps more of the company's drugs will be the subject of price negotiations in the future, which WOULD decrease its revenue from these products.

Can the pharmaceutical leader overcome these obstacles? I believe it can.

If the lawsuits Johnson & Johnson faces posed a serious threat to the company's financial health, it would not still have a credit rating higher than that of the U.S. government. In fact, J&J's strength is one of the reasons several judges have rejected its proposal to settle these lawsuits by pinning them onto a subsidiary and declaring bankruptcy.

Regarding drug-price negotiation, the company's diversified portfolio and pipeline of medicines, along with its medtech segment, should enable it to craft a strategy to minimize the impact of these developments. It also generates sufficient profits and cash FLOW to pursue licensing deals and acquisitions, thereby bolstering its business and overcoming this challenge.

So, Johnson & Johnson should be just fine.

Hedge your bets

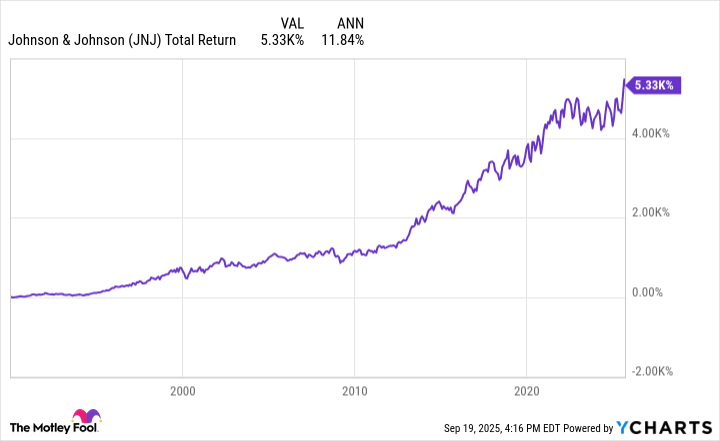

Starting with an investment of $100,000, a compound annual growth rate (CAGR) of 12.2% would be required to become a millionaire after 20 years. That's above Johnson & Johnson's long-term historical returns, even with dividends reinvested:

JNJ Total Return Level data by YCharts.

In my view, the drugmaker can't pull that off. That doesn't mean it's not an excellent stock to own, though. Very few stocks can maintain a CAGR of more than 12% over 20 years. You shouldn't count on Johnson & Johnson alone to make you a millionaire by 2045. But the company can certainly be part of a strong, well-diversified portfolio that may help you get there.