Crypto Carnage Weekend: BTC Plunges 17%, XRP Crashes 55% - ETF Deadline Looms as Potential Market Savior

Digital assets bled crimson across weekend trading sessions as market leaders Bitcoin and XRP faced brutal selloffs.

The Great Unwind

Bitcoin's 17% nosedive sent shockwaves through derivative markets while XRP's spectacular 55% collapse left traders scrambling for cover. Liquidation cascades amplified the downward spiral as leveraged positions evaporated in the bloodbath.

Regulatory Roulette

All eyes now turn to next week's critical ETF approval deadline—the potential circuit breaker this battered market desperately needs. Institutional players hover on the sidelines, waiting for regulatory clarity before deploying fresh capital.

Traditional finance veterans smugly watching from the sidelines—because nothing says 'mature asset class' like weekend volatility that would give Wall Street risk managers heart attacks.

The coming days will determine whether this is another crypto winter warning or just another buying opportunity in disguise.

Image source: Getty Images.

About the Vanguard ETF

First, it's important to understand why the Vanguard Dividend Appreciation ETF includes the stocks it does. And to do that, you have to understand the principles of the underlying index, which is theUS Dividend Achievers Select Index.

This index includes companies that are on the Nasdaq US Broad Dividend Achievers Index, with some important exceptions. First, it excludes the top 25% of companies in the index by dividend yield. That's to make sure the Nasdaq US Dividend Achievers Select Index doesn't have unstable companies with dividends that are artificially high because their businesses are unstable.

And second, the fund excludes all master limited partnerships and real estate investment trusts. Lastly, it only includes companies that have increased their dividend annually for at least 10 consecutive years.

The stocks left make up the Nasdaq US Dividend Achievers Select Index, and those names are skewed toward the technology, industrial, and financial sectors, which account for a collective 64% of the fund.

That's the index that the Vanguard ETF strives to duplicate, so you can find the same breakdown by stock and sector in it. The top 10 holdings are all blue chip names, with no stock having more than a 6% weighting.

|

Broadcom |

5.95% |

91.2% |

0.70% |

|

Microsoft |

4.8% |

27.8% |

0.69% |

|

JPMorgan Chase |

4% |

49% |

1.95% |

|

Apple |

3.7% |

13.6% |

0.41% |

|

Eli Lilly |

2.8% |

-4.1% |

0.71% |

|

Visa |

2.7% |

26.5% |

0.67% |

|

ExxonMobil |

2.4% |

-5.3% |

3.47% |

|

Mastercard |

2.3% |

16.9% |

0.52% |

|

Johnson & Johnson |

2.1% |

20.5% |

2.75% |

|

Walmart |

2% |

28% |

0.91% |

Source: Morningstar

Only two of these companies in the Vanguard Dividend Appreciation ETF's top 10 are in the red after 12 months. That's the beauty of an ETF: Rather than trying to guess the one or two best stocks to buy, you get an entire bushel of them with the Vanguard ETF.

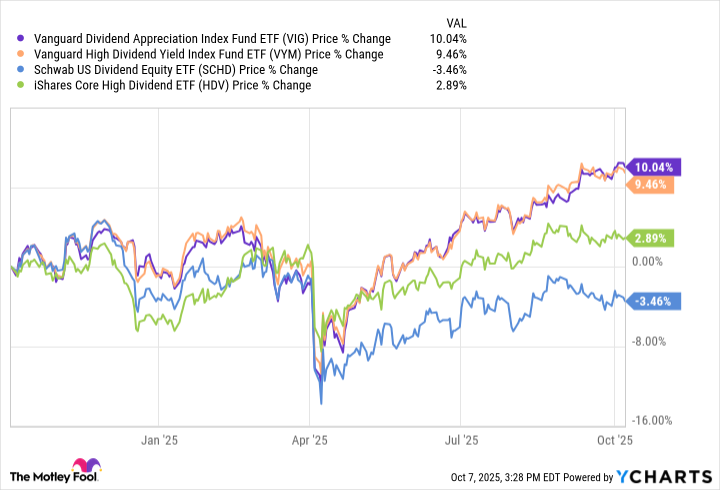

The other thing I really like about this ETF is that it gives you a good mix of performance and yield. Compared to some other popular dividend ETFs, it provides the best one-year performance, with a gain of 10%. Combine that with a dividend yield of 1.6%, and you get a nice total return from Vanguard Dividend Appreciation.

VIG data by YCharts.

The bottom line

Yes, this can be an unsettling time, and it's only natural to make sure that you're investing in a fund that can provide you with some guaranteed quarterly income, especially if you're worried that you're going to have to cover a shortfall by another source.

The Vanguard Divided Appreciation ETF provides the best combination of dividend payout and one-year performance. And when you also consider that it has a low expense ratio of only 0.05%, or $5 annually per $10,000 invested, then I'm comfortable parking funds here while waiting for the government to restart.