2030 Showdown: This AI Stock Is Primed to Crush Nvidia – Here’s Why

The AI arms race has a dark horse—and it's not who Wall Street expects.

Forget the usual suspects. While Nvidia dominates headlines with its GPU empire, an under-the-radar AI play is quietly building an unstoppable moat. By 2030, this stock won’t just compete—it’ll rewrite the rules.

The Silent Disruptor

No hype cycles, no vaporware. Just relentless execution where it counts: proprietary datasets, vertical integration, and contracts that lock competitors out. The tech? So specialized that even Nvidia’s chips can’t brute-force their way in.

Why Analysts Are Blind

Traditional metrics miss the point. This isn’t about quarterly earnings—it’s about owning the infrastructure of AI’s third wave. Think less ‘chatbots,’ more ‘industrial nervous system.’ (Cue the usual finance bros scrambling to update their DCF models five years too late.)

The 2030 Endgame

When the dust settles, the winner won’t be who sold the most GPUs—but who controls the data pipelines feeding them. And that, friends, is where this stock delivers a knockout punch.

Image source: Getty Images.

Why has Nvidia's stock been such a hit?

Over the past three years, Nvidia's stock is up 920%. When you look at what really matters, Nvidia's business comes down to graphic processing units (GPUs). GPUs are a key part of data centers, which power and enable AI training, deployment, and scaling.

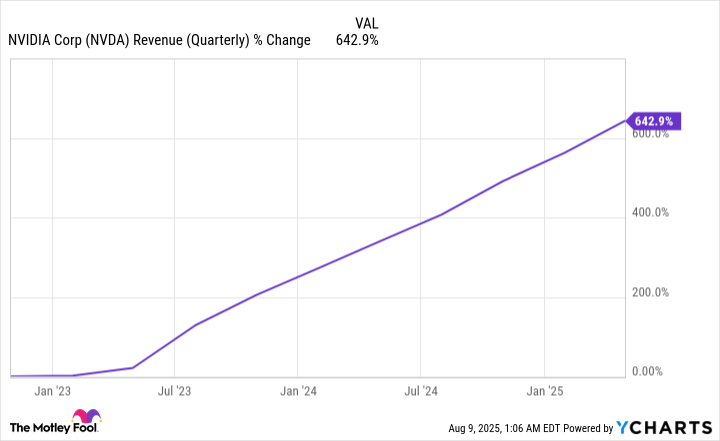

Nvidia is far and away the main supplier of AI-focused GPUs, with an estimated market share of over 90%. This VIRTUAL monopoly has paid off for Nvidia (quite literally), increasing its revenue from $8.3 billion in its 2023 fiscal first quarter to $44 billion in its 2026 fiscal first quarter (ended April 27).

NVDA Revenue (Quarterly) data by YCharts

It all starts with TSMC

Despite how valuable Nvidia and its GPUs are to the AI world, Nvidia wouldn't be able to produce them without TSMC, the exclusive manufacturer of Nvidia's GPUs and advanced chips.

If Nvidia is a flashy sports car in the AI ecosystem, TSMC is the engine that makes its performance possible, which is why I'm comfortable calling the semiconductor manufacturer an AI stock despite not presenting itself as such or having a consumer-facing AI product.

It helps to see TSMC's impact by working backward. Consumer-facing products like generative AI (ChatGPT, Gemini, etc.) must be trained using tons of data. This training isn't possible without data centers. Most of these data centers run on Nvidia chips. Nvidia chips are built by TSMC.

TSMC's business has fewer long-term risks

Although demand for TSMC-manufactured AI-related chips has driven much of its recent revenue growth, it doesn't have to rely solely on them for long-term success. Its high-power computing segment, which includes its AI-related chips, was 60% of its $30 billion in revenue in the second quarter. That's admittedly a decent bit, but TSMC's business relies more on the broad tech world, and not just AI developments.

Lots of companies rely on TSMC to manufacture their chips. Everything from smartphones to laptops to cars to gaming consoles to data center servers all contain semiconductors manufactured by TSMC. Its client list includes,,, and, just to name a few.

TSMC's diversified revenue streams reduce some potential hiccups. If AI spending and demand slows, TSMC has other segments that can pick up the slack. Nvidia's business, on the other hand, will take a major hit. Data centers accounted for over 88% of its revenue last quarter.

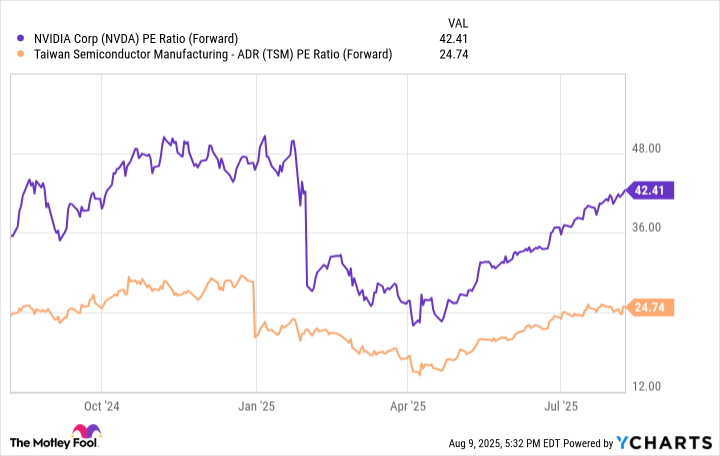

Valuation matters

At the time of this writing, Nvidia is trading at 42.4 times earnings estimates, and TSMC is trading at 24.7 times earning estimates. Although TSMC isn't considered "cheap" by many standards, it's nowhere NEAR as expensive as Nvidia and is much more fairly valued.

NVDA PE Ratio (Forward) data by YCharts

TSMC's lower valuation leaves much more room for growth over the next five years. At Nvidia's valuation, it seems to have a lot of future growth already priced into the stock, which leaves it susceptible to a sharp pullback if it falls short of its lofty expectations.

That's not to say that TSMC's stock can't experience a pullback, but its valuation gives it a larger margin of error and more upside. When we look back five years from now, I wouldn't be the least bit surprised to see TSMC's stock has outperformed Nvidia's from this point.