Roku’s Explosive Growth Trajectory Revealed in One Powerful Chart

Roku Rewrites the Streaming Rulebook—And Investors Are Taking Notice

The numbers don't lie: Roku's ascent isn't just impressive—it's rewriting the entire streaming landscape. While traditional media giants scramble to keep up, this platform keeps stacking wins like digital dominoes.

User Growth: Through the Roof

Active accounts surging, engagement metrics hitting new peaks—Roku's not just playing the game, it's changing how the score gets kept. Meanwhile, legacy broadcasters are still trying to figure out their streaming passwords.

Revenue Streams: Diversified and Dominant

Platform revenue soaring, advertising dollars flooding in—Roku cracked the code while others were still debating whether cord-cutting was 'a real trend.'

The Chart That Says It All

One visual tells the entire story: exponential growth curves that make traditional media stocks look like flatlining EKGs. But what do Wall Street analysts know? They're still trying to short Netflix.

Roku's not just winning the streaming wars—it's proving that sometimes the best investment strategy is betting on the disruptor, not the disrupted.

Image source: Getty Images.

It was fair to call Roku's stock overvalued in 2021, but the company's growth story never ended. In fact, I think Roku has many more high-growth chapters to share over the next several years, and the stock looks wildly undervalued these days.

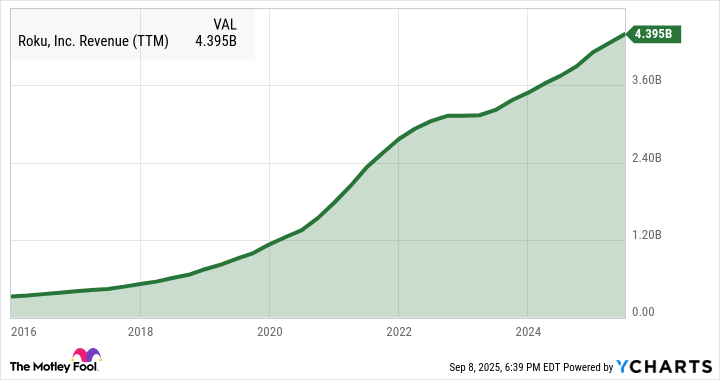

And I only need one simple chart to illustrate this concept. As you can see in The Graph below, Roku's revenues are still experiencing explosive revenue growth:

ROKU Revenue (TTM) data by YCharts

Roku plays the long game

Sure, you see an abnormal bump around the COVID-19 era. Roku saw a few quarters of unsustainable user and revenue increases there, followed by a whiplash-inducing slowdown in the inflation-based market panic of 2023. Roku's top-line sales growth hit the brakes pretty hard at that point.

Some of that was a clear-eyed and voluntary long-term growth strategy. You see, Roku saw a user-grabbing opportunity in the inflation-fighting crash. Consumers were more price-sensitive than ever and most of Roku's streaming platform rivals were staving off inflation-based costs by raising prices. Yep, those companies contributed to the very inflation problem they were battling.

Not Roku. The company held service and hardware prices steady throughout the golden lockdown years and the following penny-pinching crash. As a result, the active user count ROSE from 70 million at the end of 2022 to 80 million a year later and 90 million in Q4 2024.

Atop this expanding user base, Roku is building a massive long-term business. Revenues quickly picked up speed after the 2023 pause, as seen in that handy chart. In July's Q2 2025 report, free cash FLOW rose 23% year over year while adjusted EBITDA jumped 76%. And these are still the early innings of a long growth game.