This Beaten-Down AI Stock Could Be Poised for a Massive Comeback

AI Stock Primed for Epic Rebound After Brutal Selloff

The Sleeping Giant Awakens

Market analysts spot rare convergence of oversold signals and breakthrough AI developments—this isn't your typical dead-cat bounce. Institutional money's already positioning for the turnaround, betting big on next-gen neural networks finally hitting commercial scale.

From Bloodbath to Breakout

Short sellers got greedy, fundamentals got ignored, and Wall Street's usual herd mentality created a perfect valuation storm. Now the smart money's circling back—because nothing gets financiers salivating like buying dollar bills for fifty cents, even if they're the ones who tanked the price initially.

Image source: Getty Images.

ASML holds a rare technological monopoly in its space

Netherlands-based ASML manufactures the lithography machines that lay down microscopic electrical traces on chips. In particular, its extreme ultra-violet (EUV) machines are the only ones that can handle that part of the production process for the most advanced chips. As it's the only company in the world with this technology, every chip foundry must purchase ASML's machines when they're expanding their high-end chip production capacity.

So, whenever you hear about a new chip factory being built somewhere, you can assume that ASML will benefit.

During's (NASDAQ: NVDA) fiscal 2026 second-quarter conference call last month, CEO Jensen Huang commented that the company expects global data center capital expenditures to reach $3 trillion to $4 trillion by 2030. A decent portion of this type of spending goes toward outfitting data centers with computing equipment, and anything that has high-end chips in it, whether those are(NASDAQ: AVGO) networking switches or Nvidia GPUs, has chips produced using ASML's equipment.

With demand for data centers skyrocketing, chip foundry operators will need to increase production capacity by building new factories, as top businesses like(NYSE: TSM) are already doing. This will give a long-term boost to ASML, and its management forecasts solid growth over the next five years.

To be specific, by 2030, ASML management expects its annual revenue to be between 44 billion euros and 60 billion euros. Over the past four reported quarters, ASML has generated 32.2 billion euros, so if it hits the top end of that projected range, its revenue will almost double in the next five years. Historically, ASML's management has been extremely conservative with the guidance it gives. It was cautious with its 2025 outlook, yet it has so far produced phenomenal results. In Q2, revenue ROSE 23%.

As a result, I won't be surprised if ASML's revenuesin 2030 comes in at the high end of the guidance range. That sales growth over time should help lift the stock, but that's not the only factor that could assist ASML.

ASML isn't trading at its usual valuation

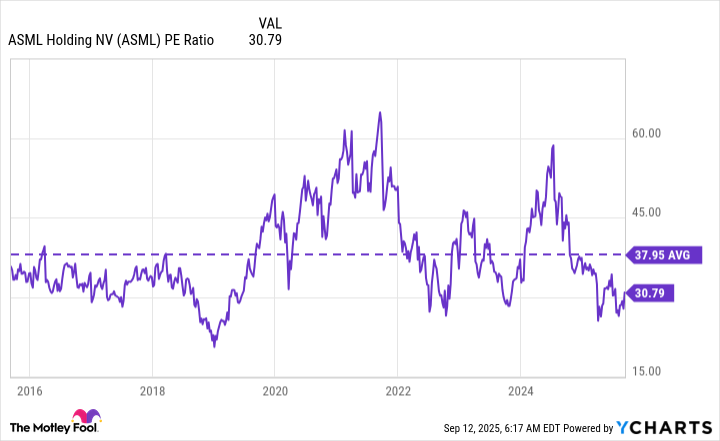

Over the past decade, ASML has traded at an average of about 38 times trailing earnings. It's cheaper than that right now, so if it rises to its average valuation level, that multiple expansion alone WOULD give shareholders an excellent return.

ASML PE Ratio data by YCharts.

ASML's bottom line generally tracks with its top line. So if its P/E ratio returns to its average level and its 2030 revenue projection comes in at the high end of management's projection, it could be a top growth stock to buy now and hold for the next five years.

The company has several positive tailwinds blowing in its favor, and the AI infrastructure spending spree is chief among them. Because foundry operators need to buy ASML's machines years in advance of when demand is expected to arrive, it's also at a smaller risk of being caught up in a bubble. This makes ASML a great way for investors of all risk tolerances to participate in the AI investment trend.