The Inside Scoop on Nvidia (NVDA) and OpenAI’s $100B Mega-Deal

Tech giants shake hands on historic AI partnership.

Behind the Silicon Curtain

Nvidia's chips meet OpenAI's algorithms in a marriage that redefines industry scale. The $100 billion figure isn't just impressive—it's a market-moving declaration of war on computational limits.

Hardware Meets Intelligence

NVDA's processing power fuels OpenAI's ambitious roadmap. This isn't just another supplier contract—it's a symbiotic relationship where silicon and software become inseparable partners in innovation.

The Financial Reality Check

Wall Street analysts already penciling in their bonuses while questioning whether this deal represents genuine innovation or just two tech titans playing monopoly money. The real test? Delivering returns that justify those eleven zeros.

This partnership doesn't just break records—it rewrites the rules of AI infrastructure entirely.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Under the agreement, Nvidia will invest $10 billion at a time in OpenAI, with each round tied to the company’s valuation as new data centers are completed. The goal is to build sites capable of at least 10 gigawatts of power, with the first expected to launch in late 2026. Although OpenAI named Nvidia as a “preferred” partner, it clarified that it is still working with Microsoft (MSFT), Oracle (ORCL), and SoftBank (SFTBF) through the Stargate project.

For Nvidia, this deal builds on other recent investments, such as $5 billion in Intel (INTC) and $700 million in UK startup Nscale. Unsurprisingly, its dominance in AI chips has made GPUs the most valuable tech in Silicon Valley, helping its market value reach nearly $4.5 trillion. At the same time, OpenAI faces the challenge of meeting skyrocketing demand for computing power while balancing relationships with existing partners.

What Is a Good Price for NVDA?

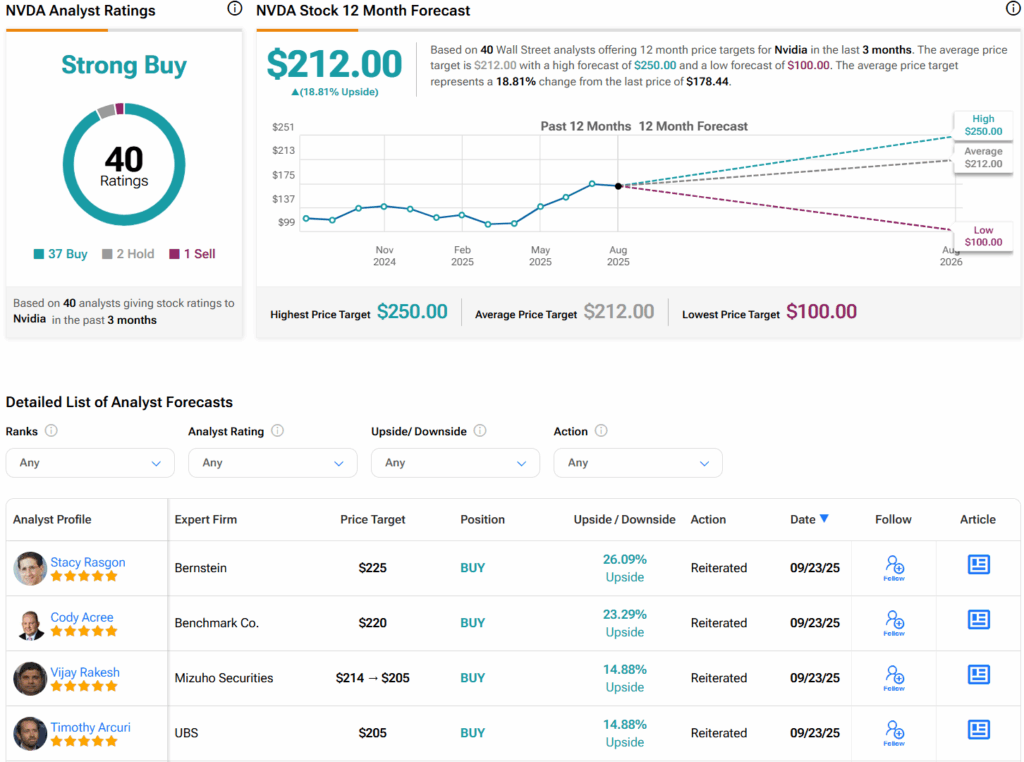

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 37 Buys, two Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average NVDA price target of $212 per share implies 18.8% upside potential.