5-Star Analyst Supercharges Amazon Stock Forecast on ’Explosive Industry Growth & Soaring AWS Estimates’

Wall Street's elite just turbocharged Amazon's trajectory.

## Cloud Dominance Accelerates

Amazon Web Services crushes expectations as enterprise migration hits warp speed. The cloud division's revenue projections leapfrog conservative estimates—because apparently legacy analysts still underestimate digital transformation.

## E-Commerce Engine Revs Higher

Retail operations defy macroeconomic headwinds with logistics networks operating at peak efficiency. Consumer spending shifts toward premium experiences and frictionless delivery—areas where Amazon maintains insurmountable moats.

## The Analyst Calculus

Upgraded price targets reflect compounding advantages across both cloud and commerce verticals. While traditional valuation models struggle to capture platform synergies, the math finally catches up to reality.

Another quarter, another reminder that betting against Bezos' flywheel remains a career-limiting move for financial pundits.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

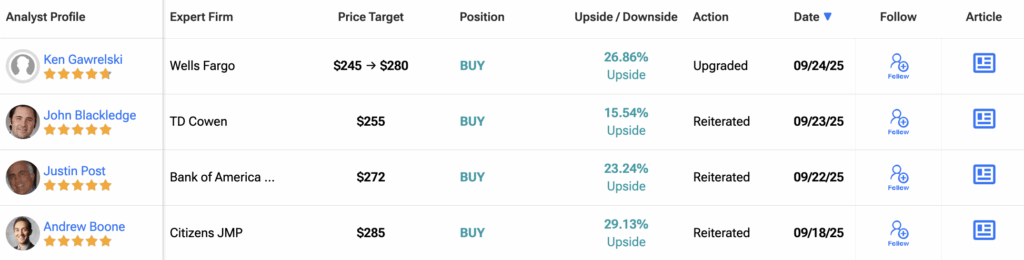

The call is built around Amazon Web Services, which Wells Fargo expects to regain momentum despite losing market share. “While share losses remain material, we take solace in stronger industry growth and rising AWS estimates,” said analyst Ken Gawrelski.

AMZN shares traded at $223.50 before the open, a modest rebound for the year’s worst performer in the Magnificent Seven. Amazon stock has barely gained in 2025, even as tech peers surged.

Project Rainier Is the Crucial Piece

The centerpiece of Wells Fargo’s thesis is Project Rainier, Amazon’s push to build a massive AI supercomputer powered by in-house Trainium chips.

Furthermore, he project will anchor Amazon’s Indiana data-center campus, with 1.3 gigawatts of computing capacity expected to go live in January and another 0.9 gigawatts ramping later. At full throttle, the site could generate $14 billion in annual revenue, Wells Fargo estimates.

Amazon’s $4 billion investment in AI startup Anthropic adds another layer, as the firm plans to train its models on Amazon’s chip clusters.

AWS Growth Set to Pick Up Speed

AWS has bled share in the cloud market, sliding from 47% in 2024 to a projected 32% by 2029, according to Wells Fargo. But analysts say the shrinking share masks the reality of an expanding overall pie.

With Rainier online, AWS growth should accelerate to 22% in 2026 from 19% in 2025, Wells Fargo forecasts. That trajectory could restore investor confidence in Amazon’s most profitable business.

Scaling the hardware will not be easy. Supply chains, customer adoption, and competition from Microsoft and Google remain hurdles. But Wells Fargo says its conviction in the AWS growth story is rising, making Amazon a stronger long-term bet.

Is Amazon a Good Stock to Buy?

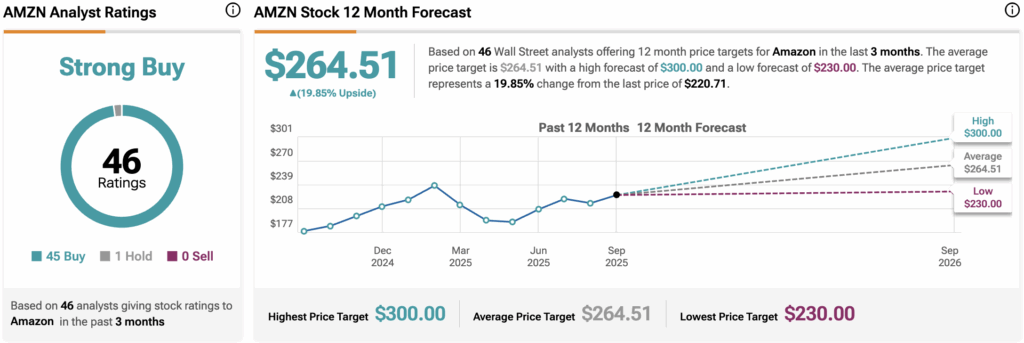

Wells Fargo is not alone in its optimism. AMZN stock has a consensus Strong Buy rating among 46 Wall Street analysts. That rating is based on 45 Buys and one Hold recommendation assigned in the last three months. The average 12-month AMZN price target of $264.51 implies 19.9% upside from current levels.

For now, Amazon’s Core retail engine still matters, but Wall Street is watching AWS as the key swing factor. If Project Rainier delivers and AI demand scales, Amazon’s stock could finally break out of its 2025 slump.