CVX, XOM, SHEL: Oil Giants Rocket Higher as Trump’s Russian Sanctions Ignite Price Surge

Black gold's back with a vengeance—and Wall Street's loving every barrel of it.

Sanctions Spark Supply Squeeze

Trump's latest move against Moscow sends crude prices screaming upward. Energy traders scramble while production forecasts tighten globally.

Big Oil's Windfall Moment

Integrated majors capitalize on geopolitical chaos. Refining margins expand as inventory draws accelerate across key markets.

The Contango Conundrum

Futures curves steepen while physical traders play storage arbitrage. Another day, another dollar—or billion—for the hydrocarbon elite.

Funny how geopolitical turmoil always seems to line certain pockets first. The oil complex thrives on chaos while retail investors chase yesterday's news.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Serious Move

Chevron (CVX) was 1.3% higher, Exxon Mobil (XOM) climbed 1.6% and Shell zoomed up over 2%.

Brent crude was up 2% to $65.76 in early trading with West Texas Intermediate futures up 3.6% to around $60 a barrel.

The surge followed President Trump’s decision to announce sanctions against Rosneft and Lukoil overnight, which he said was as a “result of Russia’s lack of serious commitment to a peace process to end its war in Ukraine.”

All assets in the US belonging to the two oil firms have been frozen, and American companies and individuals will be barred from doing business with them.

The US could also impose secondary sanctions on foreign banks that do business with the two firms or facilitate their sales to countries such as China or India.

Although, there were reports today that Reliance Industries, a top buyer of Russian oil, plans to cut or completely halt imports.

The hope is that sanctions will increase pressure on Russia’s energy sector and hamper its ability raise revenue to fund the war and support its economy. This may bring Russia back to the negotiating table to end the war.

Oil Supply

From a global economic perspective the sanctions will restrict the amount of oil on the market raising prices. This is despite lingering concerns over weak demand as a result of global economic uncertainty.

Warren Patterson, head of commodities strategy at ING, said: “The key question is whether these sanctions are enough to deter buyers of Russian oil, specifically China and India. We must wait and see if these latest sanctions are more effective or if Russia can circumvent them, as it did with curbs earlier this year. Regardless, a tougher stance on Russia by the US administration marks a shift in policy.”

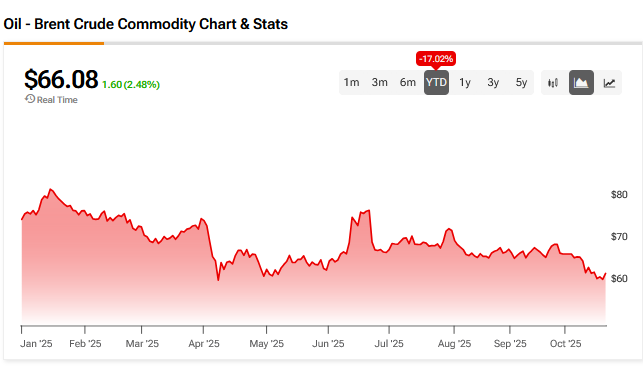

The oil price has been volatile this year hit by a number of economic and geopolitical factors such as President Trump’s tariffs strategy as well as the Middle East conflict between Israel and Iran and the Ukraine conflict.

There has also been uncertainty around the strategy of Opec nations such as Saudi Arabia , and whether it was ready to open the taps and increase supply in the market. Its moves in the days ahead will be keenly watched by investors.

What are the Best Oil Stocks to Buy Now?

We have rounded up the best oil stocks to buy now using our TipRanks comparison tool.