Nvidia’s Game-Changing Move: Leveraging Uber’s Massive Driving Dataset to Supercharge Autonomous Vehicle AI

Nvidia just turbocharged its autonomous driving ambitions by tapping into Uber's treasure trove of real-world driving data.

The Silicon Valley chip giant is feeding Uber's millions of miles of driving data into its AI training models—creating what could become the most sophisticated self-driving intelligence system on the market.

Data Gold Rush

Uber's dataset represents years of actual road experience across countless cities and conditions. Nvidia's AI processors are crunching this information to teach vehicles how to handle everything from sudden pedestrian crossings to complex urban intersections.

While other companies struggle to collect meaningful real-world data, Nvidia just bypassed years of tedious data collection by partnering with the ride-hailing giant. The move positions Nvidia's DRIVE platform as the potential industry standard—much to the chagrin of competitors still playing catch-up.

Autonomous vehicles just got a massive AI upgrade, proving once again that in the tech world, sometimes the smartest move isn't building your own dataset—it's knowing whose data to borrow. Wall Street analysts are already salivating over the potential revenue streams, because nothing gets financiers excited like cutting corners and calling it innovation.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Interestingly, this collaboration gives Nvidia access to driving scenarios that include tricky conditions, such as airport pickups, complex intersections, and bad weather. By using this dataset, Nvidia is able to post-train its Cosmos World Foundation Models, thereby allowing it to improve safety for future self-driving applications. In addition, the project relies on Nvidia’s powerful cloud computing platform to efficiently process the data.

It is worth noting that Nvidia has been putting a lot of effort into improving robotics technology. For instance, it recently backed a startup, named Lila Sciences, that is working to create “scientific superintelligence.” Lila Sciences plans to accomplish this by building facilities that use AI-controlled robotic tools to run experiments around the clock.

What Is a Good Price for NVDA?

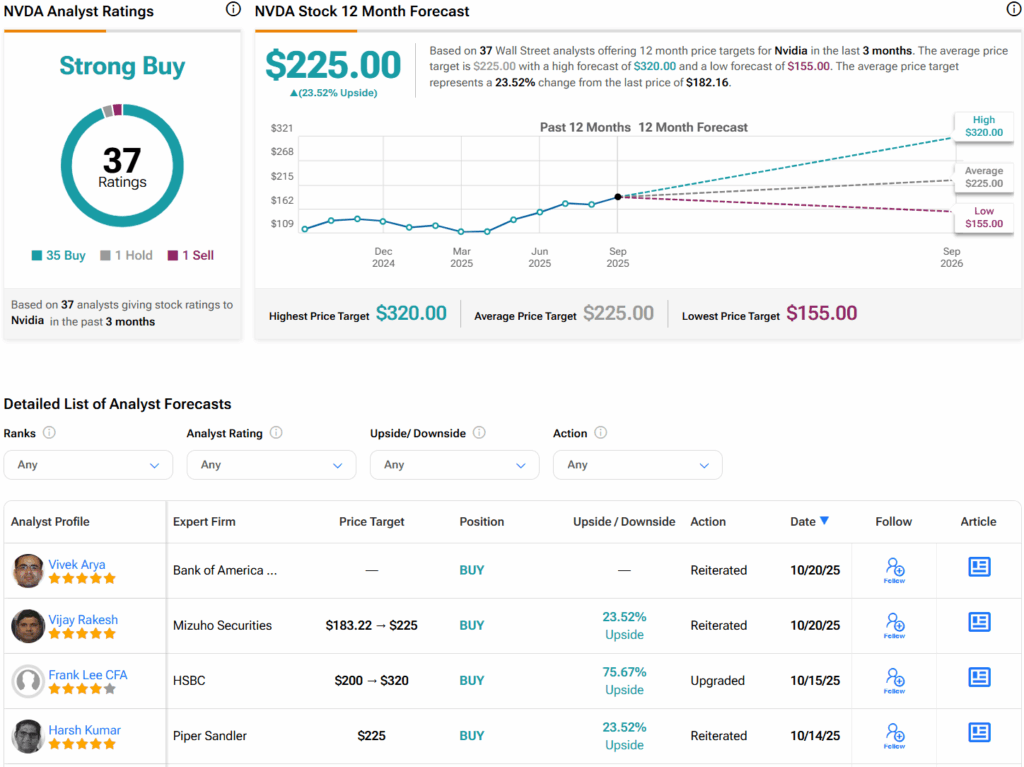

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 35 Buys, one Hold, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average NVDA price target of $225 per share implies 23.5% upside potential.