Meta’s AI Boom Just Getting Started: Analyst Upgrades to Buy Rating

Wall Street wakes up to Meta's AI dominance as another analyst joins the bull camp. The upgrade comes despite recent volatility, signaling long-term conviction in Zuckerberg's artificial intelligence roadmap.

While legacy tech firms play catch-up, Meta's aggressive AI investments position it for the next phase of growth. The move defies short-term bearish sentiment that's gripped big tech stocks recently.

One skeptic's note: 'Funny how these upgrades always come after institutional accumulation completes.'

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Freedom Capital Markets analyst Saken Ismailov upgraded Meta from Hold to Buy and set a price target of $800, pointing to strong ad growth, steady engagement across its platforms, and long-term upside from its AI initiatives.

Ismailov noted that Meta’s revenue topped forecasts in Q3, supported by robust ad demand and higher activity on Facebook, Instagram, and WhatsApp. He said Meta’s use of AI-driven recommendation tools continues to lift engagement, while early signs of WhatsApp monetization add a new source of growth.

AI Spending Adds Pressure but Supports Future Growth

The analyst acknowledged that Meta’s rising capital spending on data centers and AI systems is putting pressure on margins. Management lifted its CAPEX guidance for 2025 and plans even more investment in 2026 to strengthen its AI and metaverse capabilities.

Still, Ismailov believes this spending will pay off. He said Meta’s AI strategy isn’t fully reflected in the stock’s valuation, creating an opportunity for long-term investors. He explained that these investments may weigh on margins now, but they set the stage for stronger profits later.

Is META Stock a Buy?

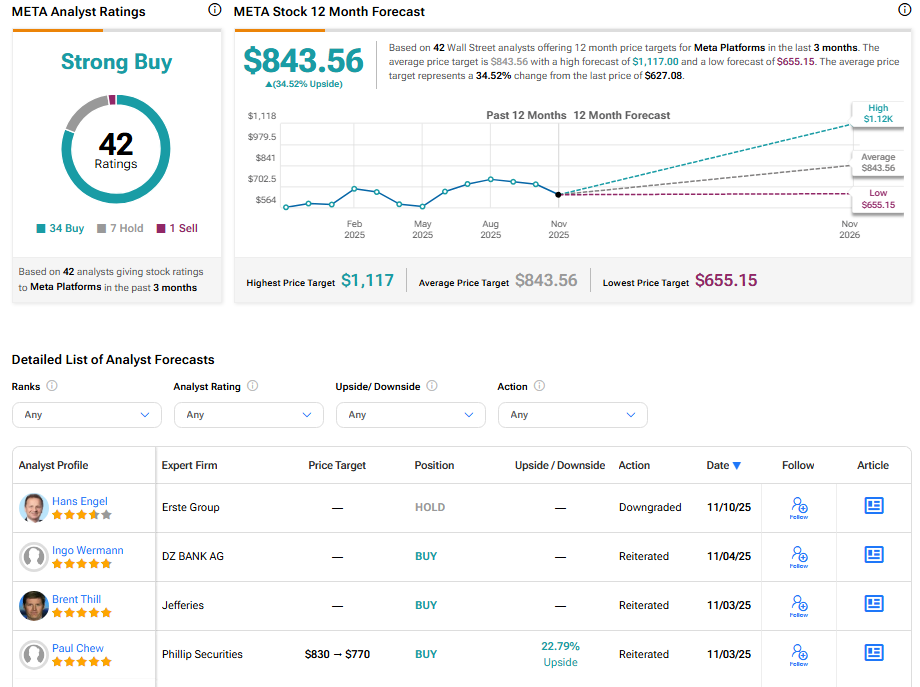

The stock of Meta Platforms has a consensus Strong Buy rating among 42 Wall Street analysts. That rating is based on 34 Buy, seven Hold, and one Sell recommendations issued in the last three months. The average META price target of $843.56 implies 34.52% upside from current levels.