Bitcoin Plummets: Crypto Market Braces for Intense Sell-off

The crypto market is getting a brutal reality check.

Bitcoin's sudden plunge has triggered a cascade of selling pressure, shaking confidence across the board. It's a stark reminder that digital assets don't move in a straight line—even when the long-term thesis remains intact.

Fear Spreads Faster Than FOMO

When Bitcoin stumbles, the altcoin market tends to trip and fall. The sell-off isn't isolated; it's a contagion of profit-taking and stop-loss triggers. Traders are scrambling to de-risk, proving once again that in crypto, sentiment can flip from greedy to fearful before your coffee gets cold.

The Institutional Pause Button

This volatility hits pause on the 'institutional adoption' narrative—at least for the headlines. While the smart money likely sees this as a buying opportunity, the sharp drop forces a recalibration. It's the market's way of separating diamond hands from paper portfolios, a necessary, if painful, cleansing.

Not a Crash, a Correction

Call it a healthy correction. Every bull market needs these shakeouts to build a stronger foundation. The fundamentals of decentralization and digital scarcity haven't changed. This is a test of conviction, not a failure of the technology.

So, is the party over? Hardly. This is just the market demanding its pound of flesh—a classic move that lets traditional finance folks feel smug for about five minutes before the next leg up. Time to separate the builders from the tourists.

$87,107.47 plummeted, testing levels below $85,000, while Ethereum

$87,107.47 plummeted, testing levels below $85,000, while Ethereum $2,930.38, the largest altcoin, dipped below $3,000. The market experienced liquidations of approximately $600 million on Monday, averaging around $400 million daily in the following days. According to a report by the leading market maker Wintermute dated December 23, 2025, market volatility was gradually subsiding, and Bitcoin was retracing to the $90,000 region. It noted that market leadership was narrowing, with capital concentrating heavily on BTC and ETH. Conversely, the altcoin market was experiencing supply pressure and weak coin unlocking schedules.

ContentsBTC and ETH Take Center Stage While Altcoins LagCurrent Market Trends

$2,930.38, the largest altcoin, dipped below $3,000. The market experienced liquidations of approximately $600 million on Monday, averaging around $400 million daily in the following days. According to a report by the leading market maker Wintermute dated December 23, 2025, market volatility was gradually subsiding, and Bitcoin was retracing to the $90,000 region. It noted that market leadership was narrowing, with capital concentrating heavily on BTC and ETH. Conversely, the altcoin market was experiencing supply pressure and weak coin unlocking schedules.

ContentsBTC and ETH Take Center Stage While Altcoins LagCurrent Market Trends

BTC and ETH Take Center Stage While Altcoins Lag

The report suggests that liquidity typically declines during the Christmas and year-end period. While discretionary trading desks closing positions kept price movements within a range, they occasionally resulted in sudden gaps. The main area of risk absorption remained the most liquid assets, Bitcoin and Ethereum. This scenario indicates that without a clear macro or policy-driven catalyst, prices are more shaped by positioning dynamics than by a convincing directional trend.

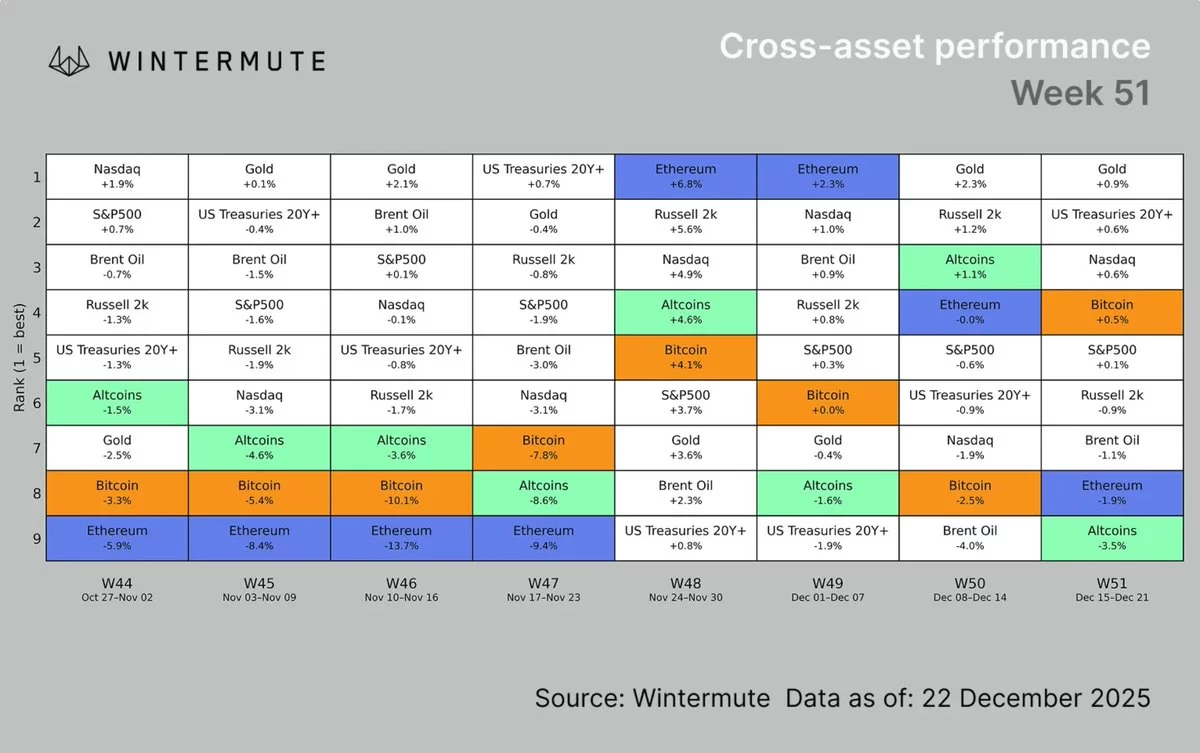

Graphical data attached to Wintermute’s report also supports the narrowing of leadership. The company’s “Cross-asset performance” chart indicates that during the 51st week (December 15–21), altcoins were the weakest performers with a -3.5% decline, while ethereum fell by 1.9%. In contrast, in the same period, Bitcoin was up by 0.5%, with gold leading at 0.9%, followed by U.S. 20-year bonds and Nasdaq at 0.6% each.

The report attributes the weak performance of altcoins mainly to the intense supply pressure described as a “supply overhang” and the heavy schedule of coin unlocking. The belief that for sustained risk appetite to take hold, bitcoin must first lead, is gaining traction as retail investors start switching from altcoins to major cryptocurrencies.

Current Market Trends

Wintermute, through its internal FLOW data, indicates a renewed buying pressure in major cryptocurrencies. Along with a prolonged buying trend in BTC, significant buying pressure signals were also observed in ETH as the year-end approaches. Institutional flows have been a consistent source of purchasing since the summer, while retail investors have been exiting altcoins and returning to major cryptocurrencies.

Meanwhile, price discovery on the margin occurs through derivative markets, allowing for sharp intraday swings alongside net buying in spot markets. The report highlights that funding and the basis remained relatively tight during sell-offs, with implied volatility remaining high in the options market. Expectations are divided between a retracement to the middle of the $80,000 region and a recovery to previous highs. Wintermute anticipates lighter activity, range-bound movements, and selective risk-taking to persist until the year-end.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.