Markets on Edge: Initial Jobless Claims Data Drops Today, Volatility Looms

Brace for impact. The latest snapshot of the U.S. labor market hits the wire today, and traders are strapping in for a potential rollercoaster.

The Pulse of the Economy

Forget the dry economic reports—this is raw fuel for the market's engine. Every new data point on jobless claims gets instantly priced in, moving billions in capital before most people finish their morning coffee. It's a direct line to investor sentiment and risk appetite.

Why Traders Are Watching

In today's hyper-connected markets, this number doesn't just reflect layoffs—it signals confidence. A rising trend spooks traditional investors and can send them scrambling for cover, often creating ripple effects across asset classes. For the astute observer, these moments of panic are just noise; for everyone else, it's a reason to check their portfolio again. After all, what's finance without a little performative anxiety?

The volatility isn't a bug; it's a feature. Today's number is just the next catalyst in the never-ending quest to find out what everything is really worth.

Why Initial Jobless Claims Matter?

Initial jobless claims measure the number of Americans filing for unemployment benefits for the first time. Even though it’s not as detailed as monthly jobs data, this report is watched closely for early signs of a weak or strong job market. Any big surprise can quickly affect bonds, stocks, and digital assets.

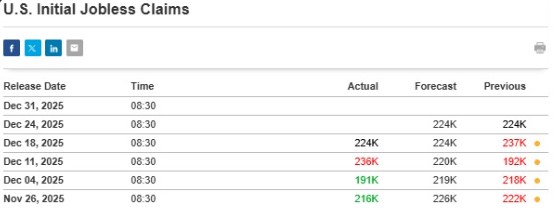

Expectations vs Previous Readings– What Comes Next?

The market expectations are fairly well understood before this event. A figure below 220,000 WOULD be taken as a sign of a robust job market, and this would lead to supportive market conditions for risk assets such as equities and crypto.

Levels ranging between 220,000 and 230,000 are quite expected and will likely result in little market action.

However, a number above 230,000 could raise concerns about a slowing economy or recession and may put pressure on financial markets.

Recent data shows mixed signals. Figures stood at 224,000 for today’s announcement, same as last Dec 18 data, while the previous week recorded 236,000, highlighting rising sensitivity to labor data as financial conditions tighten.

Crypto Markets Already Under Pressure Ahead of Data

Ahead of the initial jobless claims release, investor behavior highlights a clear contrast between hard assets and digital assets.

Precious metals have continued to outperform, with Gold (+0.50%), silver (+0.90% YTD), and platinum (+1.35% YTD) posting strong gains today as investors seek inflation hedges and safety.

In contrast, the crypto market has weakened. Total crypto marketplace capitalization fell 1.06% in the last 24 hours, extending a 1.7% weekly decline.

The major contributors to this decline include leverage unwinding, which saw Bitcoin record liquidations amounting to $60.5 million, primarily from long positions, and the funding rate rising by 102%.

At the same time, ethereum spot ETFs recorded $118.6 million in weekly outflows, while Bitcoin ETFs lost $137 million, reflecting reduced institutional risk appetite.

What Comes Next: More Releases Ahead To Shape Direction

Today’s jobless report is unlikely to be the final driver of volatility. Markets are also eyeing year’s last jobless claims report on Dec 31, CPI January 2026 report, the Federal Reserve meeting on Jan 28, 2026, and a pending MSCI ruling that could trigger $2.8–$8.8 billion in passive outflows tied to crypto-linked equities.

Until clearer macro signals emerge, labor data like today’s report is likely to remain a key short-term volatility driver across both traditional and digital markets.