Coolcoin Explodes: What’s Fueling the Rally and Can $COOL Hit Its 2026 Target After Christmas Surge?

Coolcoin isn't just cooling off—it's on fire. The token's recent parabolic move has traders scrambling and analysts revising their charts. Forget the holiday lull; this market just bypassed the usual December dip.

The Engine Behind the Pump

So what's driving the surge? Look beyond simple hype. A convergence of factors is cutting through the noise: strategic exchange listings are funneling in fresh capital, while whispers of a major protocol upgrade have the developer community buzzing. It's a classic case of fundamentals meeting momentum—a rare alignment that sends prices vertical.

Navigating the 2026 Target

All eyes are now locked on that 2026 price target. Reaching it demands more than a single rally. The path hinges on sustained adoption, not just speculative fervor. The project needs to keep delivering real utility while the broader crypto cycle plays out—no small feat in a market where today's darling is tomorrow's forgotten token (just ask any bag-holder from the last cycle).

The Road Ahead

The post-Christmas period will be the real test. Can Coolcoin consolidate these gains and build a new floor, or will it succumb to profit-taking? The chart suggests the rally has legs, but in crypto, sentiment shifts faster than a trader closing a leveraged position at a loss. One thing's clear: the quiet coin just got loud, and the market is finally paying attention—for now.

Was this the start of a real breakout or just another low-liquidity rally designed for exits?

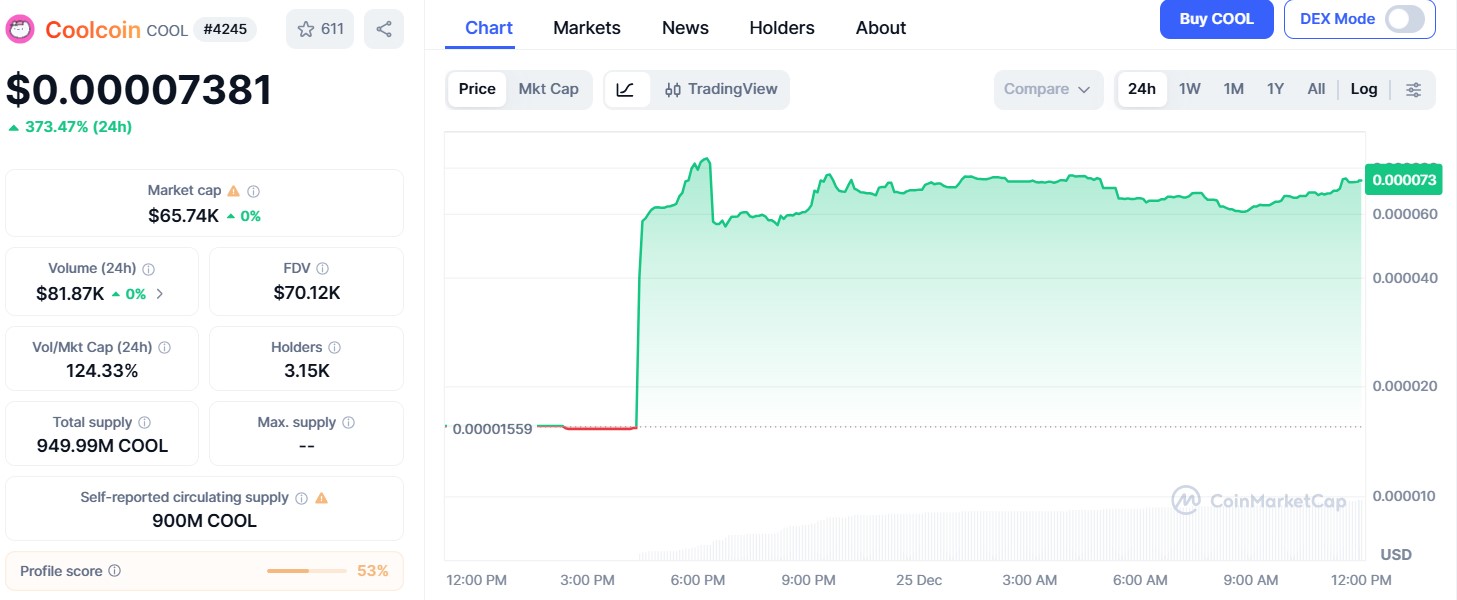

Coolcoin Price Surge Breakdown: Christmas Numbers Don't Lie

The biggest reason people noticed Coolcoin price was not only the price jump, but also the trading volume.

In the last 24 hours:

-

Trading volume jumped to $81.87K

-

Market cap around $65.74K

In crypto market analysis, volume exceeding market cap is a classic signal of aggressive speculation. This means more money was traded than the total value of the token, giving a volume-to-market-cap ratio of 124%.

In simple words, the asset was being traded very aggressively. After the big spike, the price went slightly down but stayed above $0.00007, which shows that buyers were still holding instead of selling immediately.

Why Is Coolcoin Price Going Up Without Any News? “Deja Vu Alert”

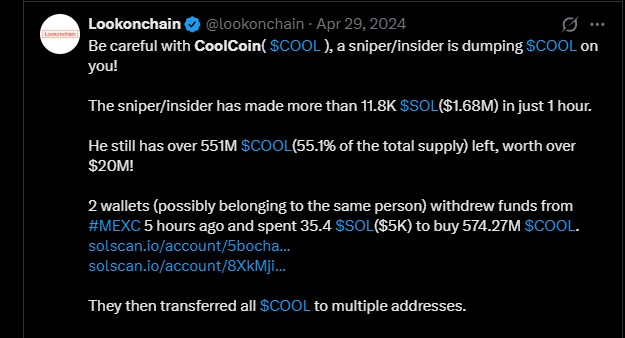

This is not the first time $COOL crypto has shown sudden price movement. This crypto christmas rally brought back a memory of a serious warning issued by the official blockchain tracking platformLookonchain data on April 29, 2024.

According to their report:

-

A sniper or insider wallet dumped $COOL

-

The wallet made 11.8K SOL (about $1.68 million) in just one hour

-

Even after selling, the wallet still held 551 million coins, which was 55% of total supply

-

Only 35.4 SOL (around $5K) was used earlier to buy 574 million of these tokens.

-

Funds were withdrawn from MEXC, showing how easily supply could be controlled

This is where concerns start. Now, history seems to rhyme: there was no official announcement, no partnership news, no roadmap update, no exchange listings, and no protocol or technology update, yet price exploded.

When a token pumps without major crypto market news, analysts usually look at liquidity and past behavior. Because of this history, the current rally is making traders nervous again.

$COOL Price Analysis: Chart Signals Strong Momentum, But Overheated

The official TradingView indicators show a short-term bullish trend, but with price being in the caution zone.

-

RSI is around 75, which means the token is overbought

-

Resistance: $0.000095 – $0.00010

-

Coolcoin Price surge parameter moved above the upper Bollinger Band near $0.000084–$0.000091, showing fast and risky movement

-

MACD is still positive, but momentum is slowing down

The overall tenchhail indicators suggest that the asset is in the bullish zone, but momentum is cooling off. The risk is high due to overbought signals and thin liquidity.

Coolcoin Price Prediction 2026: What Can Happen Next?

Based on current data and chart structure, the asset's next move depends upon the trading volume sustainability, and wallet behaviour.

1. Bullish: If price stays above $0.000085 support, and volume remains high, a move toward $0.00010 to $0.00012 is possible.

2. Most likely scenario: RSI cooling from overbought levels could push the Coolcoin $COOL price target towards $0.000068 – $0.000075 levels.

3. Bearish: If volume drops or big wallets start selling, the risk towards $0.000040 – $0.000045 is possible. Below these levels, the Christmas rally structure becomes weak.

What experts say? From a crypto analyst perspective, Coolcoin price is currently moving because of momentum, not because the project suddenly became stronger.

In conclusion, the chart shows classic low-cap breakout behaviour, where price can move fast in both the directions. Without any confirmed reason, this rally remains technically good but structurally weak.

The most important things for traders to watch next are trading volume, large whale movement, and official communication from the team.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Crypto assets are highly volatile. Always conduct your own research before making investment decisions.