India’s Crypto Tax Windfall: TDS Collections Surge 41% to ₹511.83 Crore in FY25

The taxman's crypto wallet just got a lot heavier.

### A Billion-Dollar Signal in Plain Sight

Forget the noise—follow the money. When tax withholdings on crypto transactions jump by 41% in a single fiscal year, it's not a blip. It's a bullhorn announcing mainstream adoption. That ₹511.83 crore figure isn't just government revenue; it's a direct measurement of India's accelerating digital asset economy. The volume needed to generate that sum is staggering.

### Decoding the On-Chain Ledger of the State

This surge paints a clear picture: regulated, reported crypto activity is exploding. The 1% TDS rule, once seen as a barrier, is now functioning as the most reliable metric tracker in the country. It bypasses speculative hype and measures real, taxable economic behavior. Every rupee collected represents a transaction that moved from the shadows into the compliance spotlight.

### The New P&L: Policy vs. Progress

Here's the provocative part—governments often tax what they fear or don't fully understand. Yet, by building a reliable revenue stream from crypto, India is inadvertently cementing its legitimacy. It's the oldest finance playbook: first you tax it, then you need it. That 41% growth rate is a problem for any bureaucrat thinking about blanket bans; you don't strangle a golden goose in mid-lay.

The ledger doesn't lie. While traditional finance debates theoretical risks, the tax code is quietly recording billions in real, settled value—proving, once again, that innovation outpaces regulation. And nothing legitimizes an asset class faster than the government developing a taste for its profits.

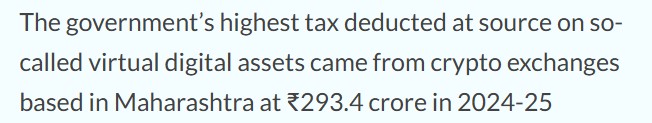

Maharashtra-based cryptocurrency exchanges contributed the most, with ₹293.40 Cr. (+30.63%) in tax deduction during financial year 2025. Karnataka followed with ₹133.94 crore (+63.4%), while Gujarat recorded ₹28.63 Cr, a slight decline of 2.3%.

Capital city, Delhi, ranked fourth, collecting ₹28.33 Cr., a sharp rise from the previous year.

These figures reflect where exchanges are registered, not where trades actually take place.

Tax Framework and Compliance Measures

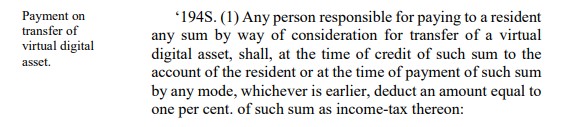

The 1% TDS rule, introduced in Union Budget 2022–23 under Section 194S, applies to all cryptocurrency transfers to help the government monitor transactions in real time. Income from virtual digital assets (VDAs) is taxed at 30%.

Between FY23 and FY25, total India Crypto TDS collections crossed ₹1,096 cr ($122 million). While Indian exchanges largely comply, overseas platforms serving Indian users remain under scrutiny.

The government has also acted against 18 digital asset exchanges for alleged GST evasion worth over ₹824 cr, and 44,000 notices were sent to unreported crypto investors.

An Unstoppable Wave: Rising Adoption

India continues to dominate as the #1 in cryptocurrency adoption. Adoption is now expanding beyond metros, with Tier-2 cities contributing 32.2% of users and Tier-3 and Tier-4 cities 43.4%. The tax deduction growth is closely linked to this wider digital asset participation.

This mass adoption, still in the absence of clear regulatory and heavy taxes, shows the strong belief of the country’s population in the virtual products.

In response to this acceptance, the government is also putting efforts towards a clear legal framework for cryptos. While the RBI, the central Bank of Country, still denies cryptocurrencies as a legal asset, some indirect laws and acts are already there in the country’s rule book while some direct ones are yet to pass.