Solana’s USX Stablecoin Peg Plunges to $0.94 After Liquidity Drain, Then Rebounds

Another day, another stablecoin wobble—this time on Solana.

The USX stablecoin, designed to hold a steady $1 value, got a harsh reality check. A sudden liquidity drain sent its price spiraling down, briefly breaking its peg. The digital dollar dropped to a worrying $0.94, leaving traders scrambling.

Anatomy of a Drain

So what happened? The mechanics are classic DeFi. Liquidity—the fuel that lets users swap assets easily—got pulled from key trading pools. Without enough buy-and-sell orders to absorb pressure, the price slipped. It’s the crypto equivalent of a bank run, just without the velvet ropes and teller windows.

The Bounce-Back

Here’s the twist: the peg didn’t stay broken. Forces within the protocol, likely arbitrage bots and stabilizing mechanisms, swooped in. They bought the discounted USX, pushing its value back toward the promised $1 mark. The system, at least for now, demonstrated a degree of resilience.

A Cynical Take on Stability

It serves as a stark reminder: "algorithmic stability" often just means "stable until it isn't." In traditional finance, a 6% drop in a currency is a crisis; in crypto, it’s sometimes just Tuesday—a brief exploit or a liquidity hiccup before the mechanics (or a dedicated team) step in to fix it.

The episode underscores the fragile dance of decentralized finance. Protocols build complex systems to maintain value, but they’re perpetually tested by market forces and, let's be honest, opportunists looking for a quick profit. For now, USX has clawed its way back, proving it can handle a punch. The real question is how many punches it can take.

What Happened?

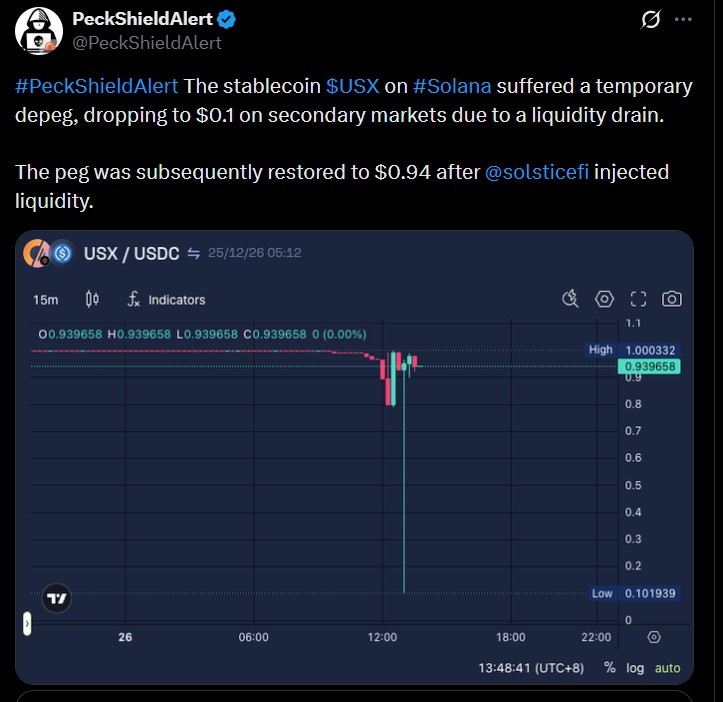

On December 26, 2025, blockchain security firm PeckShieldAlert reported that USX, a stablecoin issued by Solstice Finance on the solana network, experienced a sharp depeg in secondary markets.

The token’s price fell as low as $0.10 on decentralized exchanges such as Orca and Raydium. The decline was caused by a sudden withdrawal of liquidity, which made the market extremely thin and volatile.

Soon after, Solstice Finance stepped in by injecting capital flow, allowing the token to recover close to its intended peg, trading around $0.94. The event sparked brief panic but was quickly addressed.

Source: PeckShield X

Why Did USX Depeg?

The depeg was not caused by a hack or loss of funds. Instead, it resulted from draining secondary markets. With fewer liquidity providers available, even modest sell pressure caused USX’s price to drop sharply. Holiday trading conditions and USX’s relatively recent launch contributed to thin liquid assets, making the token more vulnerable to sudden price swings.

Was USX Insolvent?

No. Solstice Finance clearly stated that USX remained fully solvent throughout the incident. According to the team, the stablecoin’s underlying assets and net asset value (NAV) were unaffected. The token is backed by over-collateralized positions, with a collateralization ratio exceeding 100%, meaning the protocol had more assets than liabilities at all times.

What Did Solstice Do to Fix It?

Solstice Finance responded quickly by injecting additional liquidity into the secondary markets. The team also coordinated with market makers to stabilize trading conditions. Additionally, it announced plans to release an independent third-party attestation report to further reassure users about the protocol’s financial health and transparency.

Can Users Still Redeem USX?

Yes. Solstice confirmed that there was no point during the episode at which 1:1 redemptions in the primary market were stopped. This allowed users to redeem tokens at full value with the issuer, despite the prices of the secondary market being volatile.

Why Is This Important?

The incident highlights a key risk in decentralized finance: price instability can occur even when assets are fully backed. It shows that even in the case of sound fundamentals, thin liquidity can cripple prices and lead to panic.

Bigger Picture

The token has grown at a rapid pace, and the value locked is about 325 million when it was launched. Though it is a sign that the Solana-based stablecoins in high demand, it also shows problems with the rapid adoption, liquidity control, and trust in the market, especially when it comes to newer protocols.

Conclusion

USX’s brief depeg was a liquid drain issue, not a solvency crisis. The response restored confidence, offering an important lesson on the role of transparency in maintaining stablecoin stability.

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or legal advice. cryptocurrency markets are highly volatile, and readers should conduct their own research and consult a qualified financial advisor before making any investment decisions. CoinGabbar is not responsible for any losses arising from reliance on this information.