GameFi’s 2025 Slump: Delphi Digital Report Reveals Why Play-to-Earn Is Stalling

The party's over—or at least the music's slowed down. GameFi, the once red-hot fusion of gaming and decentralized finance, is hitting a rough patch in 2025. A new report from analytics firm Delphi Digital digs into the numbers, revealing a sector-wide cooldown that has investors and players alike hitting pause.

The Core Problem: A Broken Flywheel

Delphi's analysis points to a fundamental flaw in the dominant play-to-earn model. The initial promise—play a game, earn valuable tokens—relied on a constant influx of new users to drive demand for in-game assets. When that growth stalled, the entire economic engine began to sputter. Token prices dipped, player rewards lost their luster, and engagement followed suit. It turns out, building a sustainable economy is harder than slapping a token on a game.

Where Did the Players Go?

The report highlights a sharp decline in daily active users across major GameFi titles. The novelty of earning digital assets wore thin when the gameplay underneath failed to captivate. Gamers, a notoriously fickle bunch, drifted back to traditional titles that prioritized fun over financial mechanics. The 'Fi' started to overshadow the 'Game,' and the market called its bluff—a classic case of short-term tokenomics drowning out long-term fun.

A Glimmer in the Gloom?

It's not all doom and gloom. Delphi notes a quiet shift among some developers away from hyper-inflationary reward models. The focus is slowly turning back to core gameplay loops, asset durability, and experiences that retain players regardless of token price swings. The ones who might survive are those remembering they're game studios first, and unregistered securities exchanges a distant second.

The 2025 downturn serves as a brutal stress test. It's separating projects built on Ponzi-esque player recruitment from those building actual virtual worlds. The path forward isn't about finding more suckers for the next pyramid, but about building games people would play even if the money printer broke. After all, in both crypto and gaming, the most valuable asset isn't on the balance sheet—it's a user's attention. And that's one thing Wall Street has never figured out how to sustainably tokenize.

Funding Data Confirms GameFi Performance Decline in 2025

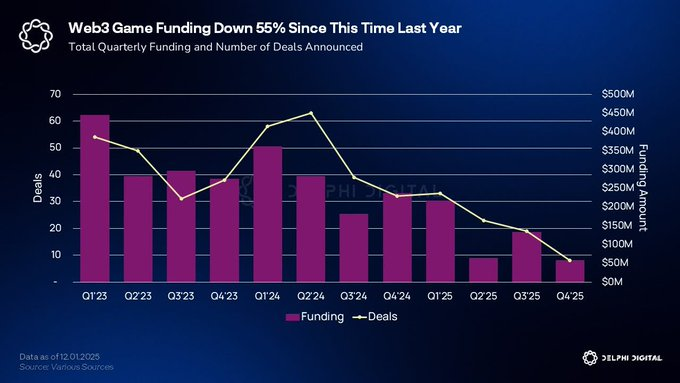

The Delphi Digital report shows a clear drop in Web3 funding. In Q1 2023, total quarterly funding was NEAR $450 million, with deal activity above 60 deals. By Q4 2025, funding fell close to $80–90 million, and the number of deals dropped below 15.

Source: X (formerly Twitter)

This confirms a 55%+ year-over-year decline in GameFi funding. Even during brief rebounds in early 2024, the trend never recovered.

A smaller number of investors were willing to fund new gaming tokens, specifically after several highly anticipated launches failed to deliver strong gameplay or long-term user growth.

Why Traditional Web3 Games Lost Momentum

One of the major aspects that resulted in the GameFi Performance Decline is incentive dependence. Most Web3 games are play-to-earn games and incentive-driven. Players are attracted by token rewards. Once these rewards slow down, people quit.

According to Delphi Digital, some projects made six or seven-figures in 2025. However, these games had limited players.

The other issue is bot traffic. Most current users are actually not actual gamers but wallets that Farm rewards. That means there is artificial engagement, and actual engagement becomes weak. Once the perks fade, engagement goes down, and that pressures developers as well as investors.

Web2.5 Games Are Quietly Gaining Strength

Despite the GameFi Performance Decline, Delphi Digital highlights the rise of this new category. These projects use blockchain only as backend infrastructure, not as the main selling point. In many cases, they do not issue tokens at all.

Studios like Fumb Games, Mythical Games, and Wemade/Wemix are generating steady revenue by using blockchain to improve ownership systems, increase engagement, or reduce platform fees. Players usually do not even notice the blockchain layer, which removes friction and enhances user experience.

Stablecoins’ Role in Blockchain Gaming

The adoption of stablecoins in gaming could assist in preventing the GameFi Performance slowdown in the coming years. The use of stablecoins makes microtransactions inexpensive and allows global payment systems and reward mechanisms without price volatility. The Web2.5 studios can harness the power of blockchain technology without having to incorporate wallets, tokens, and trading patterns on the game, attracting regular gamers who avoided previous play-to-earn models.

Conclusion

The GameFi Performance Decline in 2025 is real and backed by hard data. Funding fell sharply, deal activity collapsed, and many projects failed to hold players. However, crypto gaming is not disappearing. Instead, it is evolving.

As Web2.5 models evolve and stablecoins improve payments, blockchain gaming may return stronger, quieter, and far more sustainable than earlier.

This article is for informational purposes only, kindly do your own research before investing in any crypto gaming projects.