Lighter Token Airdrop Distribution Ignites After Massive 250M LIT On-Chain Transfer

The blockchain just witnessed a quarter-billion token shuffle—and wallets are about to get heavier.

The Mechanics of the Move

A single transaction, moving 250 million LIT tokens, triggered the distribution protocol. This isn't just a transfer; it's the starter pistol for the airdrop event itself. The on-chain data doesn't lie—the infrastructure is live and executing.

Why This Airdrop Hits Different

Forget speculative promises. This distribution follows verifiable, on-chain activity. It rewards early network participants and liquidity providers based on pre-defined, transparent criteria. No backroom deals—just code fulfilling its function.

The Ripple Effect

Massive token movements like this create immediate liquidity events. They test network resilience, put exchange deposit addresses on high alert, and often precede volatile price discovery phases. It's a stress test and a party invitation rolled into one.

A cynical observer might note this is a fantastic way to manufacture 'organic' trading volume—but hey, at least the tokens are actually moving to real users this time. The real work begins now: will holders stake, sell, or simply watch?

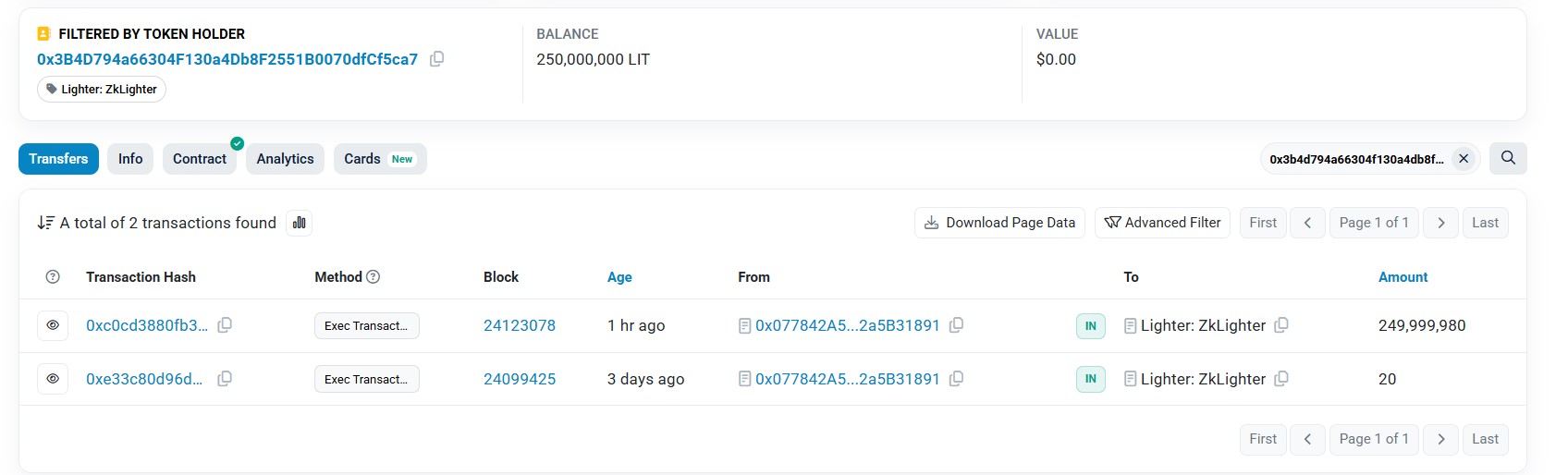

What Just Happened On-Chain?

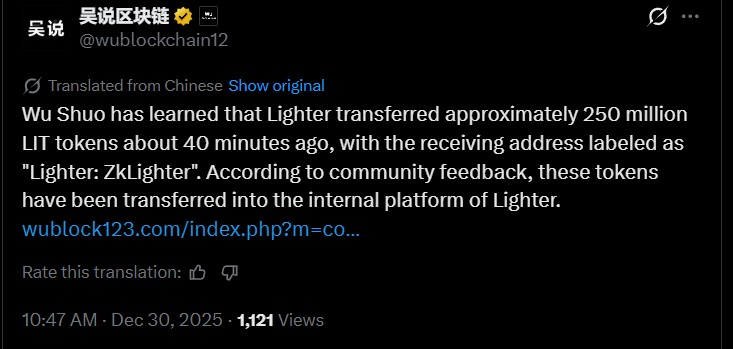

Lighter moved about 250 million LIT tokens to an internal wallet named ZkLighter. Community monitoring proved that the transaction was made approximately 40 minutes before the start of the discussion.

The tokens were not transferred to the external wallets but deposited into the internal system of the platform, according to the feedback.

This action is consistent with the project plan to automatically distribute LIT to qualified users without claims, indicating the beginning of live token distribution.

Source: Wu Blockchain X

LIT Token Distribution Officially Begins.

On Discord, the distribution of LIT tokens has started, which was confirmed by the lightweight team members.

Users will not have to manually claim tokens, and balances will be displayed on their asset pages.

Its implementation is still in progress, and not all of the users can view their allocations.

According to community reports, the visibility will increase slowly as the distribution process is being completed on the eligible accounts.

Source: X

$LIT Tokenomics

The supply is fixed and is divided equally between the ecosystem and team/investors.

Using the ecosystem allocation, 25% of the total supply is being distributed today via an airdrop that is pegged to points accumulated in 2025.

The other 25% is set aside for future points seasons, partnerships, and growth initiatives.

The team and investor tokens will have a one-year lock-up period and three-year linear vesting.

The breakdown of the allocation is 26% to the team and 24% to the investors.

Source: Official Account

LIT is used as an infrastructure and fee tokens in the ecosystem of Lighter. It has execution services, access levels based on staking, verification, and market data services. Financial products that enhance capital efficiency and risk-adjusted returns are also available to the holders.

Lighter Airdrop Mechanics

The Lighter Token airdrop will be based on the points program, and the 2025 seasons 1 and 2 will earn 12.5 million points in total. According to community feedback, every point can be redeemed for around 20 LIT tokens.

Distribution is automatic in the platform, which removes gas fees or risks of claims. Sybil filtering has also been used by LIT to make sure that there is equitable distribution and to avoid abuse. The airdrop rollout is still going on,n and the balances are being shown out to users progressively.

Less emphasized partnership with strategic partners and investors, such as Robinhood and LIT on Coinbase. Such alliances are designed to enhance infrastructure creation and connect traditional finance with decentralized trading solutions based on Ethereum.

Lighter TGE

The Token Generation Event (TGE) is associated with the rollout of the airdrop, which officially introduced LIT as a native asset of the platform. The token is being issued by a C-Corporation registered in the U.S., which enhances regulatory transparency and helps Lighter to pursue its long-term ecosystem expansion strategies and decentralized infrastructure.

The project affirmed that 100% of the protocol revenue of its DEX and future products will be paid to holders. The decision to distribute revenue will be between ecosystem growth and token buybacks, depending on the market circumstances, and all operations can be observed on-chain.

Lighter Crypto Price Expectations

The overall reaction to the launch by the community has been favorable, with the no-claim airdrop model and definite token utility motivating it. LIT's Pre-market trading price is said to have been valued at around $4, and some market participants estimate a fully-diluted valuation of between $1 and $2 billion.

Nonetheless, fake tokens and phishing schemes have also been reported by the users as interest is increasing in the initial Lighter Token listing date and trading stages.

Vision and Conclusion

The platform is a Core building block to the future of finance, which is the bridge between DeFi and TradFi with verifiable, efficient infrastructure. The project will grow responsibly through transparent revenue sharing and long-term incentives to 2026 and beyond.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. crypto assets are highly volatile, and you can lose your entire investment.