Crypto Market Crashes Today: The Real Reasons Behind the Plunge & What 2026 Holds

Crypto markets tumble—again. A wave of red sweeps across exchanges, wiping billions from the total market cap. It's not just a dip; it feels like a flush. So what triggered the sell-off?

The Usual Suspects: Macro Meets Crypto

Blame a perfect storm. Hawkish whispers from central banks sent traditional markets reeling, and crypto, ever-sensitive, followed suit. Liquidity vanished faster than a meme coin's promises. Then, a major exchange faced a flash liquidation cascade—automated systems selling into thin bids, accelerating the drop. Add in some regulatory saber-rattling from a key jurisdiction, and fear did the rest.

Technical Breakdown: Support Levels Shattered

Key technical levels meant nothing. Major psychological supports for flagship assets crumbled under the pressure, triggering stop-loss orders en masse. The domino effect was brutal. Leverage, crypto's double-edged sword, cut deep this time. Over-collateralized positions were liquidated, feeding the downward spiral. It was a stark reminder: in crypto, gravity is optional until it's not.

The 2026 Outlook: Building on Broken Glass

Look past the panic. This volatility is the market's immune response—flushing out excess leverage and weak hands. The core thesis for 2026 remains intact: institutional adoption is a slow-moving freight train, not a day trader's rocket. Real-world asset tokenization and scalable Layer-2 solutions are being built right now, in the bearish gloom. The next cycle won't be powered by hype alone, but by utility you can actually use. Think less 'number go up,' more 'network effect.'

The Bottom Line

Crashes are a feature, not a bug. They're the market's brutal way of recalibrating price to reality—or at least, to the latest narrative. For 2026, the smart money isn't watching the charts; it's watching the developers. The infrastructure being coded today will define the next bull run. Just remember, in finance, a 'correction' is just a crash that happens to rich people's portfolios first.

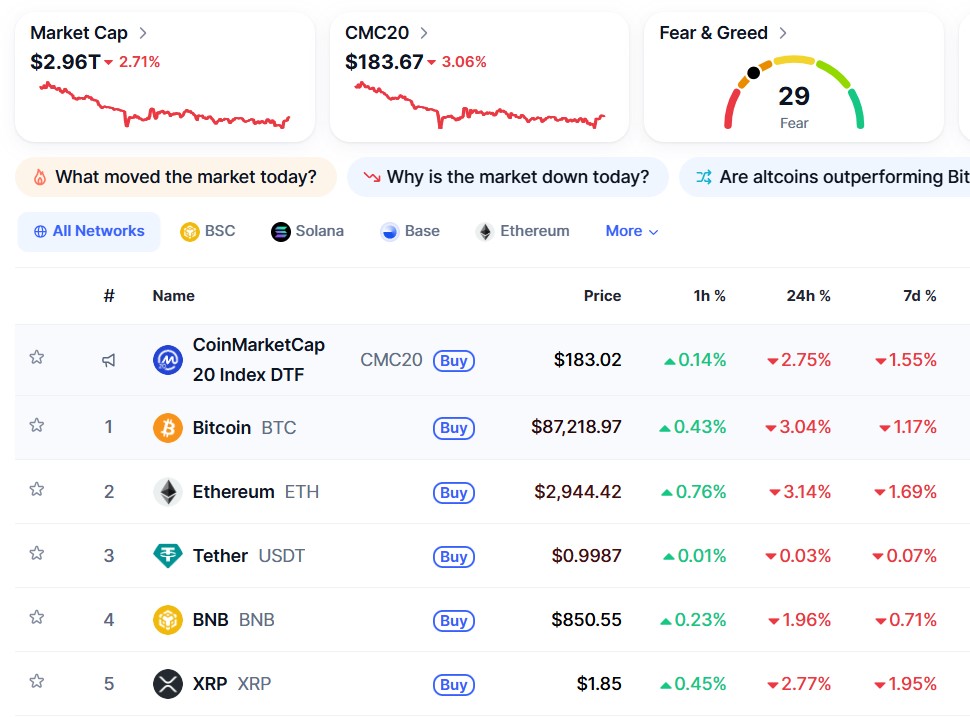

Big names are at the top of this drop: Bitcoin (BTC) has fallen to $87,216.94, ethereum (ETH) is down over 3% to $2,943.50, and XRP has slipped to $1.85.

While these red numbers are scary, understanding why this is happening, and will it recover in 2026 is very important.

Why is the crypto market down today? The industry is crashing today because of three main "shocks": a political fight between President Trump and the Federal Reserve, China blocking silver exports, and over $210 million in trades being "liquidated", and more. Let’s understand the crypto crash reasons in detail and what next.

5 Major Reasons Behind Why Is Crypto Crashing Today

A big reason for the Crypto Market Down movement is a public argument in the U.S. government. According to a post by Eric Daugherty on X, President TRUMP is demanding that the head of the Federal Reserve, Jerome Powell, resign immediately.

Trump even said he "might still" fire him. This makes investors very nervous as they fear a destabilized monetary policy, interest rate shift and more. When people get scared, they usually sell risky assets like Bitcoin to play it safe.

China’s Silver export ban, starting January 1, is hurting cryptocurrency. In the latest crypto market news today, since China controls about 70% of the world's silver, this "supply shock" is making the precious asset very valuable.

According to market reports, investors are moving their money out of digital coins to buy metals to protect their wealth. As investors prioritize "safe-haven" silver over digital gold, the lack of available capital has pulled the Crypto Market down.

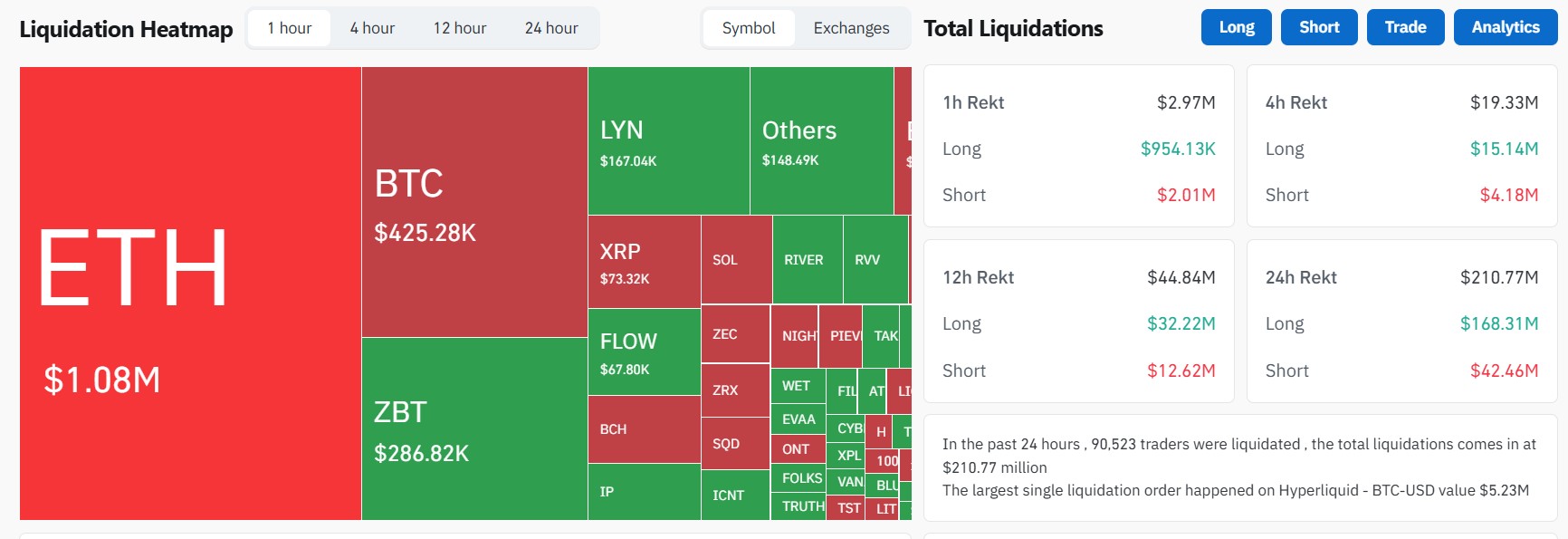

When prices drop a little, it often triggers a giant crash because of "liquidations." Data from Coinglass shows that over 90,551 traders had their accounts wiped out today, losing $210.79 million.

Many of these people borrowed money to bet that prices would go up. When the $BTC ETH XRP price crashed, a $5.23M loss on the Hyperliquid exchange acted like a falling domino, forcing other trades to close automatically. This forced selling is one of the biggest reasons why crypto is down today.

Big Investors are currently pulling their money out. Based on data from Wu Blockchain, digital asset investment products saw $446 million exit in just one week.

Specifically, bitcoin ETFs saw $782 million in outflows. Even though some people are still buying Solana or XRP, the fact that the biggest investors are taking their "billions" out of Bitcoin and Ethereum.

Everyone around the industry is waiting for the Federal Reserve’s "FOMC" meeting notes to be released today, December 30. Investors are in a state of "Extreme Fear" scoring only 23 on the sentiment index.

They are worried the government will announce higher interest rates or stricter rules on money. To avoid losing more, many traders are selling their coins now to wait and see what happens.

Roadmap To What Next: Will Cryptocurrency Recover in 2026?

Even though 2025 has been a year of massive political and technical hurdles, experts believe 2026 will be the year of the big comeback. According to Coingabbar’s top expert’s 2026 Crypto Market Outlook, new laws and better technology like "stablecoins" will make cryptocurrency a normal part of the global bank system.

Nate Geraci, co-founder of the ETF Institute, shared that experts at Hashdex expect the "AI Cryptocurrency" market to grow to $10 billion.

Stablecoins are projected to double in market cap as they "re-dollarize" global trade.

Tokenized Real-World Assets (RWA) are expected to grow by 10x.

The AI Cryptocurrency sector is forecasted to reach a $10 billion valuation.

With interest rates expected to drop and Jerome Powell’s term ending in May 2026, more money will likely FLOW back into the system. Today's Crypto Market Down momentum might just be a temporary dip before a massive 2026 recovery.

Investing in digital asset is very risky because prices can change incredibly fast. This article is based on current news and data and is meant for learning only, not financial advice. Always DYOR before making any investment decision