Bitcoin Birthday in 1 Day: Turning 17 a Make or Break Year for BTC?

Bitcoin hits 17 tomorrow—and the crypto world holds its breath. Is this the year the digital gold finally grows up, or just another cycle of hype and heartbreak?

The Teenage Rebellion Phase is Over

Seventeen years. That's longer than most fiat currencies survive a recession. Born from a whitepaper, Bitcoin has weathered bans, bubbles, and billion-dollar blow-ups. It's no longer the rebellious teen of finance; it's applying for its first real job in the global economy.

Institutional Adoption or Speculative Stagnation?

The trillion-dollar question: Will legacy finance finally fold Bitcoin into its aging portfolio? Wall Street's embrace feels more like a cautious handshake than a bear hug—every ETF approval celebrated like a moon landing, while traditional asset managers still treat crypto like a risky side bet. One cynical take? The suits love volatility; it gives them something to 'manage' for a hefty fee.

The 17-Year Itch

This birthday isn't just a milestone; it's a mirror. Scaling solutions need to deliver. Regulatory clarity must emerge from the fog. The 'digital gold' narrative has to prove it's more than just a shiny story during market routs. The network either matures with its age or gets left behind by nimbler, purpose-built chains.

Make or Break? Probably Both.

Predicting Bitcoin's path is a fool's errand—just ask the experts who've called its death hundreds of times. Seventeen likely won't be a single defining moment. It'll be a year of grinding progress and gut-wrenching pullbacks, of institutional nods and regulatory scowls. The only guarantee? It won't be boring. The original cryptocurrency either solidifies its foundation this year or watches its throne get chipped away—one blockchain birthday at a time.

Bitcoin Birthday: Journey From a Crisis Paper to a Global Money Experiment

The origin story starts on October 31, 2008. A short document titled “Bitcoin: A Peer-to-Peer Electronic Cash System” introduced a new idea: money that could MOVE online without a central bank, right as the world was dealing with a major financial crisis.

The real “launch day” came later. The first block—called the genesis block—was mined on January 3, 2009. That date is the true Bitcoin Birthday, and it is why January 3 matters more than any marketing event.

Price discovery came slowly. The first documented exchange trading for dollars appeared in late 2009. Then came the bitcoin pizza day, moment that made history feel real: on May 22, 2010, 10,000 coins were spent on pizza—proof that this internet money could buy something in the real world.

The Big Legitimacy Shift: ETFs and State-Level Signals

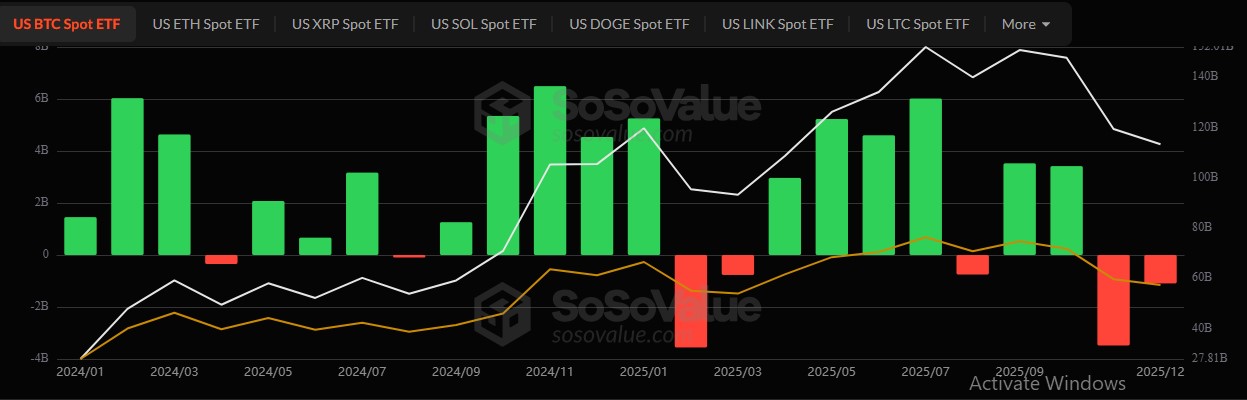

One significant turning point came in January 2024 with the U.S. SEC’s approval of spot ETFs related to the asset on a regulated market. This made it easier for big investors to access it.

However, there are still FLOW movements correlated with market sentiments. Based on the SoSoValue data, the spot ETFs finished the month of December 2025 with a net outflow of $348.10M on Dec 31, along with total inflows and outflows for 2025 as $31.02B and $9.65B, respectively.

Then came a far more important political signal. On March 6, 2025, President Donald TRUMP signed an executive order to create a Strategic Bitcoin Reserve and a U.S. Digital Stockpile. Many market observers regard this as a significant turning point since it is no longer treated as a specialized asset but rather as an investment.

Bitcoin Halving History and Future of Supply

The other prime driver evident here that fuels this rise is the concept of supply. This will go on to lessen the rewards for miners every four years, or around 210,000 blocks on the network. The previous halving, which took place in April 2024, decreased rewards to 3.125 per block, down from 6.25. Prior to this, there have been previous instances of reward decreases in 2012, 2016, 2020, along with the next one set to occur in 2028, based on a Bitbo chart. The importance of this timeline was highlighted, as markets have a habit of "pricing the next cycle" earlier than anticipated.

Bitcoin Price Prediction 2026: What’s Next for BTC?

Q4 2025 drop represents the first definite warning signal in the story of Bitcoin’s 17th year, as the price dropped by more than 35% from October 1 to December 25, sliding from $125,922 to $81,072, eventually stabilizing at or around current prices.

As of now, Bitcoin price is trading around $88.8K, which is only a little above the current value of $88,852. The technical pattern of Bitcoin is quite clearly defined. The immediate support level lies in the $88,000-87,500 range, whereas the basic support for the bull trend is at $85,000.

Any hard break below $85K might unleash potential downside movements towards $80,000-$78,000, while in a DEEP bear market, the price might fall towards the $40,000 level. Resistance points on the flip side are $92,000, $96,000-$100,000, with a strong resistance level spanning $108,000 to $112,000.

Momentum stays weak with RSI close to 45 and MACD flat to slightly negative, implying a consolidation trend.

Conclusion

Bitcoin Birthday is more than a mere digit, as it has already overcome 17 long years, upgrades, and the worldwide spotlight. What’s next in 2026, most likely, is based on the return of demand for ETFs and the price remaining at or over $85K. A major move past $92K can reverse the situation, while remaining below $85K is a problem for the next couple of months.

This piece is intended solely for educational purposes, not a source of financial advice or a guide on how to engage in any kind of trading activity. The nature of the crypto market is such that it’s extremely volatile. It’s imperative to fact-check all the data provided here.