Grayscale Makes Power Move: Files for Bittensor Spot ETF Under GTAO Ticker

Grayscale just lobbed a grenade into the crypto ETF arena. The digital asset giant officially filed with the SEC for a spot Bittensor ETF, proposing to trade under the ticker GTAO. This isn't just another application—it's a direct play for the red-hot AI-crypto narrative.

The GTAO Gambit

By targeting Bittensor, Grayscale is bypassing the crowded Bitcoin and Ethereum ETF battlefield. They're going straight for the infrastructure powering decentralized machine intelligence. The filing signals a massive institutional bet that AI and crypto convergence is the next trillion-dollar frontier, not a passing trend.

Why This Filing Cuts Through the Noise

Most ETF filings blur together in a haze of legal jargon. This one stands out. Grayscale isn't asking for permission; it's staking a claim. The move pressures regulators to keep pace with an asset class evolving faster than their rulebooks. It also throws down a gauntlet to other asset managers still fiddling with Bitcoin futures—time to level up or get left behind.

The Ripple Effect

Approval won't come easy, but the mere filing injects rocket fuel into Bittensor's legitimacy. It telegraphs to traditional finance that a select few altcoins have graduated from 'speculative crypto' to 'institutional-grade tech asset.' Expect a scramble as other firms rush to file for their own niche thematic ETFs, lest they miss the wave—a classic case of FOMO driving finance forward, one regulatory filing at a time.

One cynical finance jab: Nothing gets Wall Street's attention like a fresh ticker to pump before the fundamentals are fully understood.

The bottom line? Grayscale isn't just following trends anymore; it's attempting to set them. The race for the next-generation crypto ETF is officially on, and it's looking a lot smarter than before.

Hybrid Creation Mechanism Targets Institutional Access

The filing detailed two distinct order types enabling authorized participants to facilitate share creation and redemption.

In-kind orders allow broker-dealers to deposit TAO directly into BitGo’s custody vault or withdraw assets during redemptions.

In contrast, cash orders utilize Coinbase as a prime broker to execute purchases on behalf of participants through segregated accounts.

Cash transactions employ either variable-fee structures, in which liquidity providers absorb price differentials, or actual execution orders that place price risk on authorized participants between trade-date NAV and final settlement values.

The trust calculates net asset value daily at 4:00 PM Eastern using the CoinDesk TAO CCIXber Reference Rate, with cascading backup protocols that default to the Coin Metrics Real-Time Rate or Coinbase spot pricing if the primary index becomes unavailable.

BNY Mellon serves as administrator and transfer agent, while Coinbase Custody Trust Company handles digital asset safekeeping alongside BitGo, though the trust currently prohibits staking activities pending IRS guidance on grantor trust tax treatment.

Grayscale committed to irrevocably abandoning rights to tokens from network forks or airdrops to preserve the structure’s tax classification, potentially forfeiting future value from protocol upgrades.

European ETP Wave Signals Broader Altcoin ETF Competition

The Grayscale filing arrives as Deutsche Digital Assets and Safello launched the Safello Bittensor Staked TAO ETP on SIX Swiss Exchange in October, offering 1.49% fee exposure to staking rewards through the Kaiko Safello Staked Bittensor Index.

That product generated immediate institutional interest, as TAO rallied 42% in October to $427.59, though the token has since declined to current levels amid broader crypto market year-end outflows.

![]() Bitwise files 11 crypto strategy ETFs with SEC targeting DeFi, Layer-2, and privacy protocols for NYSE Arca trading.#Bitwise #ETFhttps://t.co/4lfgX8jyOM

Bitwise files 11 crypto strategy ETFs with SEC targeting DeFi, Layer-2, and privacy protocols for NYSE Arca trading.#Bitwise #ETFhttps://t.co/4lfgX8jyOM

Bitwise simultaneously filed for eleven strategy-based crypto ETFs on December 30, including a dedicated TAO product alongside funds tracking AAVE, UNI, NEAR, SUI, STRK, ZEC, ENA, and other protocols.

The wave of applications followed the SEC’s October 2025 introduction of generic listing standards, which eliminated case-by-case approval requirements and accelerated institutional product launches across formerly restricted altcoin markets.

Speaking with Cryptonews, RAY Youssef, CEO of NoOnes, noted that altcoin ETF launches are “colliding with tight liquidity, low investor confidence and pronounced market underperformance,” but argued new listings “create a steady inflow channel that can serve as a liquidity buffer.”

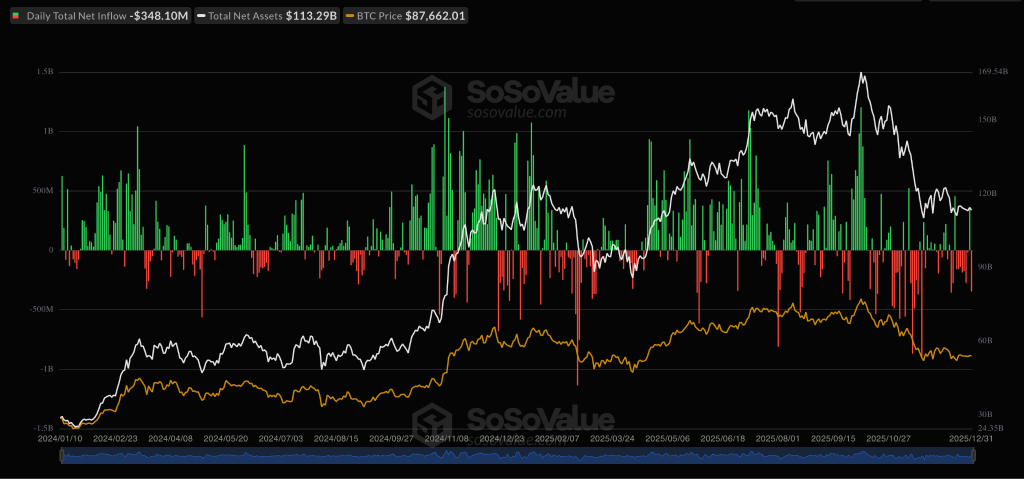

Ending 2025, XRP ETFs posted six consecutive days of inflows exceeding $420 million, while Solana products attracted $2.29 million on December 31 even as Bitcoin and ethereum ETFs recorded combined outflows of $420 million that session.

Despite immediate market headwinds, Grayscale’s filing positions the firm to capture institutional demand once macro conditions stabilize.

The trust’s net asset value declined 51.6% year-over-year to $4.24 per share as of December 31, trading at a 124% premium to NAV at $9.50 market price.

Notably, the filing disclosed risks, including TAO’s historical volatility ranging from $188.82 to $709.06 annually, potential SEC classification that could force liquidation, and irreversible custody losses from compromised private keys despite multi-signature cold storage protocols across geographically distributed facilities.