Chainbounty Price Surges 96% - Will This Crypto Bounty Hold or Crash?

Chainbounty just ripped 96% in a single session—traders are scrambling, skeptics are scoffing, and everyone’s asking the same question: Is this sustainable or just another crypto pump waiting to dump?

The Anatomy of a Surge

Ninety-six percent moves don’t happen in a vacuum. They’re fueled by a cocktail of speculation, momentum trading, and often a catalyst that triggers FOMO across retail platforms. The surge suggests heavy accumulation, but whether it’s smart money positioning or a coordinated play is the real mystery.

Technical Tells and Trading Psychology

Watch the volume. A surge on thin volume screams manipulation—a classic “pump” setup. High volume with sustained buying pressure hints at deeper conviction. Right now, charts are flashing extreme overbought signals. History shows assets rarely hold these vertical climbs without a healthy pullback. The next 48 hours will reveal if this is a breakout or a blow-off top.

Market Mechanics & Liquidity Traps

Crypto markets are notoriously shallow. A few large orders can catapult a low-cap token like Chainbounty, creating an illusion of momentum. The real test comes when early buyers try to cash out. If the sell-side order book evaporates, that 96% gain can reverse faster than a Wall Street banker’s promise.

Fundamentals vs. Frenzy

Has anything fundamentally changed for Chainbounty? A 96% revaluation should reflect a seismic shift in utility, adoption, or protocol development. If the project’s roadmap and user metrics haven’t budged, then this is pure price discovery driven by sentiment—the riskiest kind of rally.

Will It Hold or Crash?

The crypto graveyard is littered with tokens that spiked triple-digits only to collapse below pre-pump levels. Sustainability requires continuous buying pressure, developer progress, and often, a forgiving broader market. In today’s climate, with regulators circling and macro uncertainty looming, holding gains is a brutal battle.

One cynical truth? In crypto, a 96% surge isn’t a victory—it’s just the first chapter. The second chapter usually involves a lot of bag-holders and tweets that start with “I can’t believe this dump…” Trade accordingly.

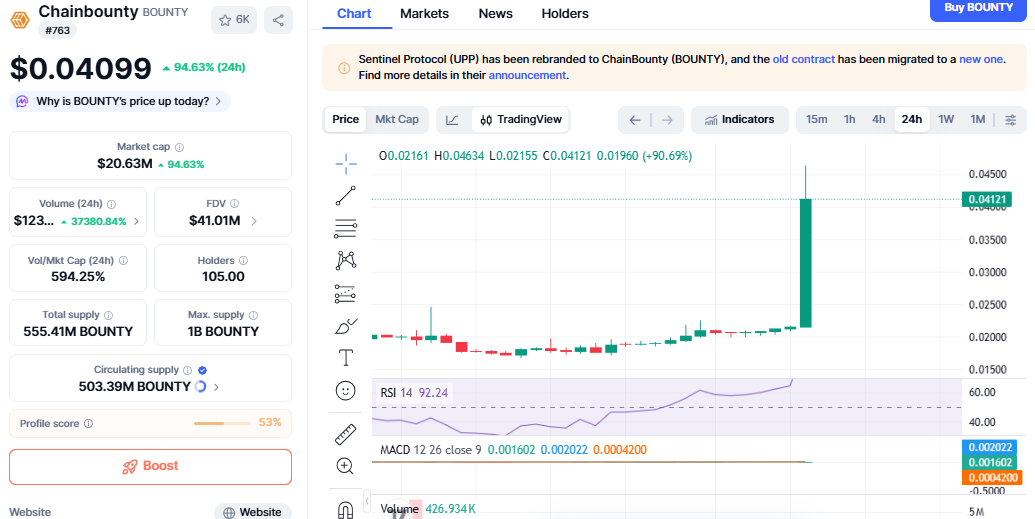

Source: CoinMarketCap

All these events were happening while the rest of the crypto market was trending downwards, making this Chainbounty price surge even more noticeable.

Involvements of this nature do not happen to smaller tokens very often that quickly pushed $Bounty into the spotlight.

What Happened Before the Chainbounty Price Surge?

Before this rally, it was trading quietly. The price stayed in a narrow range NEAR $0.02 for several days. There was no major movement, and interest was low.

Then suddenly, buyers stepped in. The chart shows a strong breakout candle that pushed the price above the $0.03 area. Once that level was crossed, buying increased rapidly. This is often how sharp rallies begin, and it explains why the Chainbounty price surge happened so fast.

Volume Shows Real Buying Interest

One of the strongest signals on the chart is trading volume. Volume exploded compared to previous days. This means many traders were actively buying and selling, not just a few wallets moving the price.

When price rises together with heavy volume, it usually shows strong interest rather than a random spike.

Indicators Show Strength but Also Caution

The momentum indicators on the chart indicate strong buying pressure. The RSI has broken above 90, an indicator that the asset is highly overvalued in the short term.

What this does not mean is the rally itself is finished. What it means is that the price has moved too quickly, too fast. In these situations, markets usually follow a more stable path or experience a small withdrawal in price.

MACD is still in the positive zone, indicating that the momentum is still upward. All these indicators point towards strength, but volatility is also expected to increase.

Will Chainbounty Hold the Rally or Pull Back?

This is the big question now. Based on the chart, the area between $0.033 and $0.035 is very important. If the price stays above this zone, it shows buyers are still in control.

It could try to MOVE higher and test the $0.045 area next.

The price may drop toward $0.028 or even $0.025. As the crypto price prediction suggests, this would still be normal after such a strong move and would not erase the Chainbounty price surge entirely.

Final Thoughts

The Chainbounty price surge is one of the most noticeable moves in the market right now. It is supported by a clear breakout and heavy trading activity.

At the same time, the rally came very fast, which means short-term ups and downs are likely. Whether it continues higher or pauses will depend on how well it holds key support levels in the coming days.

For now, the cryptocurrency has clearly caught the market’s attention and traders are watching closely.

This article is for informational purposes only and not financial advice, kindly do your own research before investing.