Morgan Stanley Ethereum ETF Filing: Wall Street’s Crypto Capitulation is Here

Wall Street just blinked—and the message is clear. Forget the cautious whispers and regulatory hand-wringing. Morgan Stanley, a titan of traditional finance, has officially filed for an Ethereum ETF. This isn't a toe-dip; it's a cannonball into the deep end of crypto.

The Institutional Floodgates Are Opening

The filing cuts through years of institutional hesitancy. It bypasses the old guard's skepticism and signals a fundamental shift in asset allocation strategy. When a firm managing trillons for Main Street America makes this move, the 'digital gold' narrative evolves into 'digital infrastructure.' They're not just betting on price—they're betting on the network.

What This Means for the Market

Expect a domino effect. Other major asset managers will now scramble to file their own versions, lest they miss the wave. This brings unprecedented liquidity and, crucially, legitimacy. It provides a regulated on-ramp for capital that was previously sitting on the sidelines, intimidated by private keys and non-custodial wallets. The approval process itself will be the next major battleground, watched closer than any Fed meeting.

The New Finance vs. Old Finance Dynamic

Let's be cynical for a second: this is also about fees. Wall Street excels at packaging disruptive technology into familiar, fee-generating products. An ETF structure lets them profit from the crypto revolution while sidestepping the actual philosophy of decentralization—a neat trick, if you can get away with it.

The genie isn't going back in the bottle. The filing proves that institutional demand can no longer be ignored or dismissed. The future of finance is being built on-chain, and the old masters of the universe are now rushing to buy a seat at the table—before someone else builds a better table entirely.

The filings highlight how major Wall Street firms are increasingly entering the crypto space, reflecting wider adoption of cryptocurrencies through familiar and regulated investment vehicles.

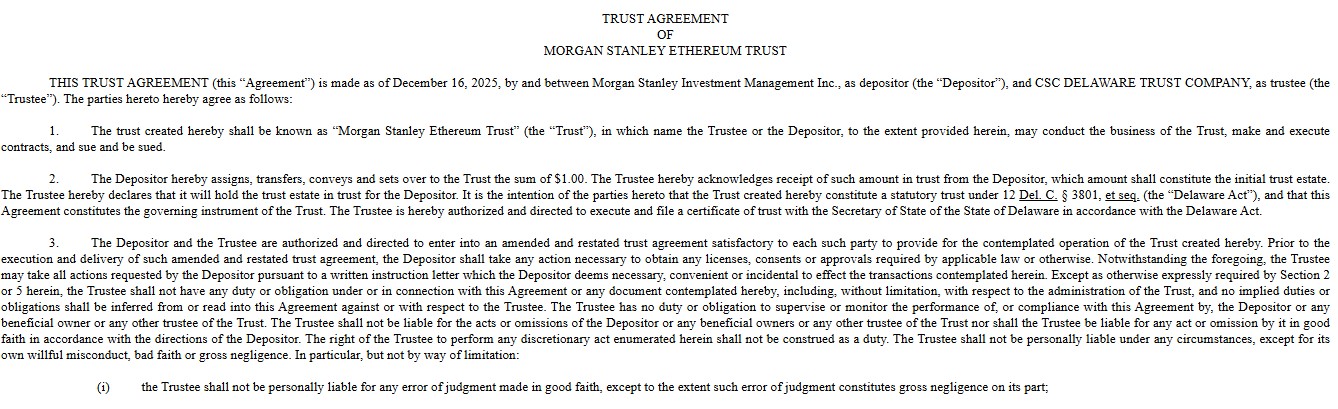

What Morgan Stanley Actually Filed

MorganStanley, which manages around $1.7–1.8 trillion in assets, submitted S-1 filings to the SEC on January 6, 2026, for two products:

A spot Bitcoin ETF, tracking BTC prices directly

A spot Solana ETF, including staking rewards

This marked the first time a major U.S. bank, not just asset managers like BlackRock or Fidelity, applied to launch its own spot-crypto ETFs.

Ethereum ETF Filing Confirmed a Day Later

Following the two previous filing, Morgan Stanley followed up with a confirmed filing for a Ethereum-ETF. The proposed fund WOULD hold ETH directly and stake part of its holdings through third-party providers, aiming to generate extra yield.

If approved, this would make Morgan Stanley the first major U.S. bank to issue a spot Ethereum ETF, signaling deeper institutional confidence in ETH.

Other Ether ETFs on the Market

Ethereum funds already exist from key players:

BlackRock iShares ETH Trust (ETHA): low fees and high inflows

Fidelity ETH Fund (FETH): institutional-friendly option

Grayscale Ethereum Trust (ETHE & Mini Trust): first to enable staking, with payouts starting Jan 6, 2026

Bitwise's ETHW, VanEck's ETHV, ARK/21Shares Ethereum ETF, Invesco Galaxy ETH ETF, and Franklin Ethereum's EZET

Together, these products manage $19–20 billion in assets, showing strong investor interest and adoption. Morgan Stanley’s entry adds credibility and competition in this growing space.

Matter for Broader Crypto Markets: ETFs on High Demand

Wall Street adoption is accelerating. Bitcoin-ETFs already hold over $120 billion in assets, and Ethereum-ETFs have seen renewed inflows in early 2026 after a slow end to 2025.

The Solana-ETF’s staking feature has also drawn attention, with analysts estimating $10–20 billion in potential inflows if approved.

Together, these filings strengthen crypto’s position as a mainstream investment option.

The Bigger Picture

This move signals a major step toward institutional adoption of cryptocurrencies. MorganStanley’s filings strengthen the legitimacy of Ethereum, Bitcoin, and solana as investment options.

With Wall Street involvement increasing, 2026 could mark a turning point for crypto’s integration into traditional finance. Investors are watching closely to see if approvals follow and how inflows could impact prices.