South Korea Supreme Court Greenlights Bitcoin Seizure from Exchanges—Legal Precedent Set

South Korea's top court just handed authorities a powerful new tool—and the crypto world is watching.

The Ruling in Plain English

Forget anonymous wallets. The Supreme Court's decision confirms that law enforcement can legally compel cryptocurrency exchanges to freeze and surrender Bitcoin holdings linked to criminal investigations. It’s a landmark move that bridges the gap between digital assets and traditional asset forfeiture laws.

Why This Changes the Game

This isn't just about seizing coins. It’s about formalizing the exchange's role as a regulated gatekeeper. The ruling effectively treats custodial holdings on platforms as seizable property, similar to funds in a bank account. It forces a compliance shift—exchanges must now have the technical and legal frameworks to act on court orders.

The Compliance Hammer Drops

Local exchanges are scrambling. Operational protocols need an overhaul to handle rapid freeze-and-transfer requests. For a sector already navigating strict KYC rules, this adds another layer of regulatory overhead—and cost. Some see it as a necessary step toward legitimacy; others fear overreach.

The Bigger Picture: Cleanup or Crackdown?

Proponents hail the decision as a blow against crypto-enabled crime. Critics warn it sets a precedent for state overreach into digital asset ownership. One cynical take? Traditional finance veterans are probably chuckling—watching crypto finally get the same regulatory 'privileges' as the banking system they love to hate.

Bottom line: The rules of the game just got stricter. South Korea is drawing a hard line, proving that in the eyes of the law, Bitcoin can be tracked, taken, and treated like any other asset—whether the crypto-anarchists like it or not.

Major crypto trading platforms of the country like Upbit and Bithumb, come directly under this Bitcoin Seizure verdict. Where Upbit accounts 53% of the total 10.17 million crypto users of the country, Bithumb holds around 37% accounts. Seizure on this exchange could directly affect the user's perspective.

However, legal experts say this decision sets an important precedent for future crypto investigations, trials, and legislation.

What Made the Supreme Court To Do So?

The ruling is a result of the 2020 money laundering case. The lawsuit started with Mr. A, who was under investigation for money laundering in 2020. Authorities seized 55.6 BTC from his exchange account, worth about 600 million KRW at the time. Mr. A argued that Bitcoin is not a “physical object” and therefore should not be confiscated.

The lower courts disagreed, saying Bitcoin has real economic value and can be controlled by the owner using private keys or wallets. The case went to the Supreme Court, which dismissed Mr. A’s appeal in December 2025. The Court ruled that Bitcoin, even when held on exchanges, is an electronic asset that can be seized just like any other property.

Why This Ruling Matters: A Subject Of Clear Status For Crypto

This decision clears confusion about the legal status of cryptocurrencies on exchanges. The ruling states that digital assets also hold value and come under asset laws, and can be verdictable.

It builds on earlier rulings for same topics:

In 2018, the Supreme Court recognized Bitcoin as intangible property that can be confiscated if earned illegally.

In 2021, it confirmed BTC as a virtual asset that can be transferred, stored, and traded electronically.

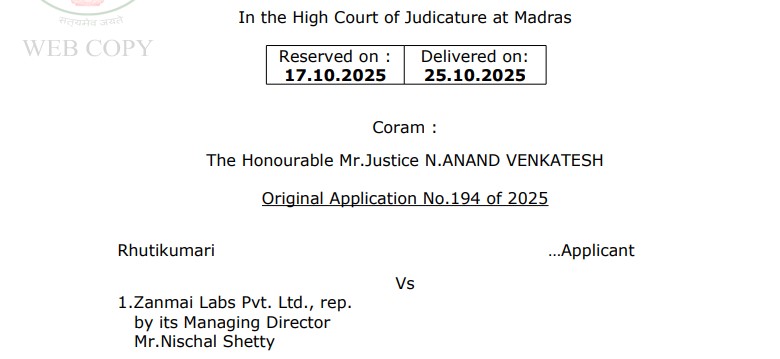

Before that, the Madras High Court of India also presented a landmark ruling over crypto’s status. The court has officially recognized cryptocurrency as a FORM of property, granting it the same legal protection as tangible assets in Rhutikumari v. Zanmai Labs case.

What It Means for Users and the Market

For crypto-holders: While this provides clarity, it also highlights areas to watch carefully. Storing coins on centralized exchanges carries risk. Users may consider self-custody wallets for better control.

For law enforcement: Investigations into fraud, money laundering, and other crypto crimes become easier.

For the crypto-market: The ruling gives BTC and other virtual assets stronger recognition as legal property and economic power.

Lawyers say the decision sets an important precedent for future investigations and legal cases, making the treatment of cryptocurrencies more consistent.

In the End

As crypto adoption grows, especially in countries like South Korea where about one-third of the population holds digital assets, this Bitcoin Seizure ruling could change how people store and protect their coins.

Could this be the moment for cryptocurrency to get a wide space as a monetary value and users to rethink where they keep their assets?