Tether Freeze Rocks Crypto: $182M USDT Locked in Major Action

Tether just pulled the emergency brake—hard. The stablecoin giant froze a staggering $182 million worth of USDT, sending shockwaves through the entire digital asset ecosystem. It's a stark reminder of the centralized power lurking beneath the decentralized dream.

The Anatomy of a Freeze

This wasn't a minor adjustment. Tether's action represents one of the largest single freezes in recent memory, directly targeting specific wallets. The move highlights the company's ability to intervene—effectively hitting pause on millions in liquidity with a single command. For traders, it's a sudden, forced exit; for the market, it's a liquidity tremor.

Centralized Control in a Decentralized World

The incident cuts to the core of a major crypto contradiction. While blockchain promises user sovereignty, major stablecoins like USDT operate with traditional, centralized oversight. Tether can blacklist addresses, freezing funds to comply with regulations or investigations. It's a necessary evil for mainstream legitimacy, perhaps, but it grates against the 'be your own bank' ethos. A classic finance move—building trust by retaining the power to revoke it.

Market Ripples and Regulatory Reverberations

Expect volatility. A freeze of this magnitude can create immediate selling pressure on connected assets and spook the broader market. It also hands ammunition to regulators, who will point to it as proof that oversight is not just possible but already happening. For every skeptic who said stablecoins were a ticking time bomb, this is a 'told you so' moment—even if the system worked as designed.

The $182 million question isn't just where the frozen funds went, but where the industry goes from here. This action proves that for all its disruptive potential, crypto still dances to the old tune of compliance and control. The future might be decentralized, but the present still has a very big 'off' switch.

Tether News Today Confirms Law Enforcement Driven Wallet Freeze Action

A spokesperson confirmed that the freeze was done after a formal request from law enforcement agencies. The investigation had been active for several months before the action was taken. It stated that it works closely with authorities worldwide and freezes wallets linked to illegal activity or sanctions violations when valid requests are made.

The freezing is in line with Tether’s voluntary freezing policy that began in December 2023. Tether service terms allow it to freeze addresses or access user information when necessary and for legitimate reasons. It respects the OFAC guidelines set by the U.S. Treasury.

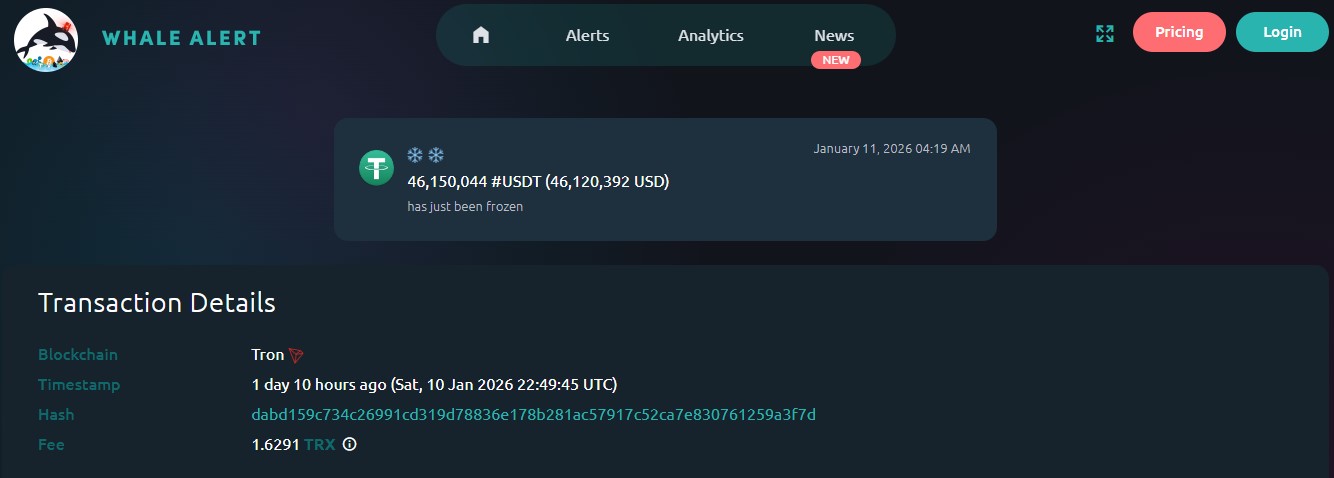

A Single Day Freeze That Stands Out on Tron Blockchain

The January 11 freeze is specifically important for its scale and coordination. Five wallets were restricted within hours, each holding large balances. Such activity shows how fast centralized stablecoin issuers can act when risks are identified.

Tether Freeze Over $3 Billion to Support Global Investigations

The Stablecoin platform has now blocked more than $3B worth of USDT globally. It works with over 310 law enforcement agencies across 62 jurisdictions. As of July 2025, more than 2,380 wallets holding around $1.14 billion were frozen for U.S. agencies including the FBI and U.S. Secret Service.

Why Tether’s Enforcement Is Much Larger Than Its Competitors

According to a December 2025 AMLBot report, the total frozen assets since 2023 are nearly 30 times greater than Circle’s USDC, which froze around $109 million in the same period. AMLBot also states that it froze about $3.3B from 2023 to 2025 and blacklisted 7,268 wallet addresses.

Tether News Today Shows Stablecoins Lead in Illicit Crypto Activity

Stablecoins are now the main tool used in illegal crypto transactions. A Chainalysis report shows they accounted for 84% of all illicit crypto activity in 2025, totaling at least $154 billion.

At the same time, it dominates the stablecoin market. USDT has over $187 billion in circulation, making up 64% of the total $292 billion stablecoin market. USDC follows with nearly $75 billion in supply.

Conclusion

Tether news today shows how serious the stablecoin market has become. Freezing $182 million in USDT in one day proves that compliance and security now shape crypto’s future. As stablecoins grow, strict enforcement will likely become normal across the digital asset ecosystem.

This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.