Trump’s Bold Crypto Tax Removal Plan Ignites Fresh Optimism for Bitcoin Adoption Surge

Trump's crypto tax proposal just dropped a regulatory bombshell—and the market's reacting like it's 2017 all over again.

Policy Shockwaves

Imagine buying a coffee with Bitcoin and not worrying about a capital gains form. That's the core promise suddenly on the table. The plan aims to strip away the tax reporting nightmare that's kept everyday users and institutions on the sidelines, treating crypto more like currency than property. It's a direct challenge to the old guard's playbook.

Adoption Catalyst or Political Theater?

Proponents see a floodgate moment. Removing tax friction could finally push crypto from speculative asset to usable money, driving merchant adoption and wallet growth that metrics have projected for years. Skeptics whisper it's a classic political carrot—dangled to capture a voting bloc, with implementation details murkier than a memecoin's whitepaper. After all, Wall Street still loves its taxable events.

The Bottom Line

Whether this plan becomes law or not, it reframes the entire conversation. It forces a debate on whether the U.S. will strangle innovation with paperwork or carve a path for it. One cynical take? The traditional finance giants are already calculating how to profit from the volatility this news cycle creates—some things never change. The hope for real adoption, however, just got its biggest boost in years.

Source: X (formerly Twitter)

Many believe this could finally make it useful for daily spending, not just investing.

Trump Crypto Tax Removal Could Make Payments Simple

Today, every crypto payment is taxable event in the U.S. Even buying coffee with BTC requires tracking profits and losses. This policy could change that. If small payments become tax-free, using digital currency WOULD feel as easy as using cash or a debit card.

Paul Barron said this could remove the biggest barrier stopping this digital money from becoming real money. No more tracking tiny transactions. No more stress over small taxes. This could help the U.S. compete with regions like Dubai, Singapore, and Hong Kong.

Strategic Bitcoin Reserve Shows a Big Shift

At the March 7, 2025 summit, President TRUMP criticized how the U.S. government sold tens of thousands of Bitcoin years ago. Those coins would now be worth billions. He signed an executive order to create a Strategic Bitcoin Reserve.

The U.S. now holds between 200,000 and 328,000 BTC from legal cases like Silk Road. That is worth over $20 billion today. In the past, around 195,000 BTC were sold for only $366 million.

This MOVE shows a shift in thinking. Holding Bitcoin instead of selling it is what Trump reaffirms now.

Taxes Are Still Active Right Now

It is important to be clear. It is not law yet. Congress must pass any change.

Currently, digital asset is taxed under capital gains rules. Short-term gains are taxed between 10% and 37%. Long-term gains are taxed between 0% and 20%. Digital currency income is reported on FORM 1040, while trading activity goes on IRS Form 8949 and Schedule D.

From 2025 onward, brokers must also report transactions using Form 1099-DA.

There was talk of a $600 de minimis exemption that would make small payments tax-free. It was discussed but removed from major bills. With elections coming, Trump Crypto Tax Removal ideas are gaining attention again.

Crypto Market Reacts With Optimism

The market has already reacted positively. Total market cap ROSE 0.9% in the last 24 hours after staying flat for a week.

BTC saw heavy liquidations as short sellers were forced out. ethereum and Solana also gained strength due to ETF hopes and policy optimism.

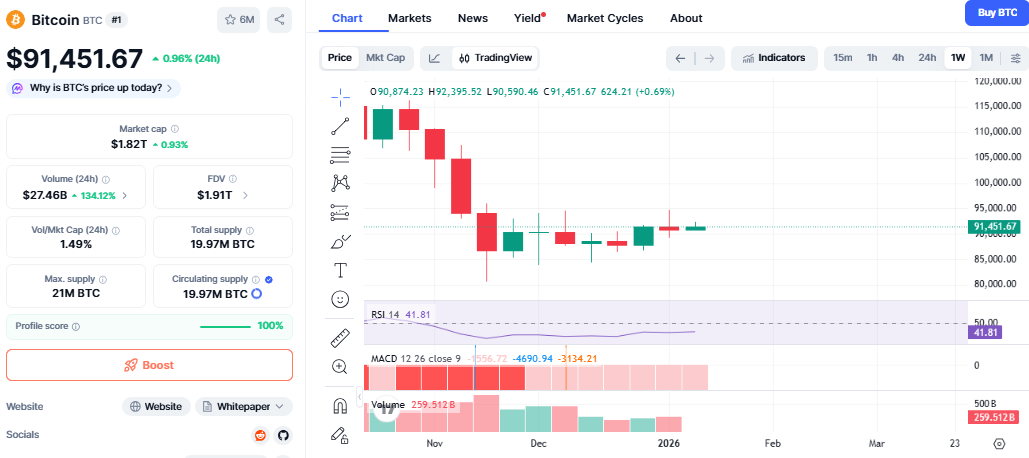

Bitcoin Price Today Shows Strength

BTC is trading NEAR $91,500 after rising 0.78% in 24 hours. It has reclaimed its 7-day moving average. MACD shows buying momentum, while RSI remains neutral, meaning there is room for growth.

Source: CoinMarketCap

Holding above $91,500 could push it toward $100,000 in the coming weeks.

What Does It Mean Moving Ahead?

Trump Crypto Tax Removal could turn this class of asset from an investment into everyday money.

People could buy groceries, pay bills, and shop online without tax worries.

It would boost wallets, payment apps, stablecoins, and digital currency adoption across the U.S.

For Bitcoin, it could mean shifting the narrative from “digital gold” to “digital cash.”

Trump Crypto Tax Removal would not just change taxes. It could change how the world uses virtual currency.

This article is for informational purposes only and not a financial advice, kindly do your own research before making any investment decision.