Ethereum’s 2026 Rally: Why the Smart Money Is Betting Big Now

Forget the noise. While traders chase the next meme coin, a quiet storm is brewing for Ethereum. The stage is set not for a blip, but a structural bull run that could redefine digital asset portfolios. Here's what the charts—and the fundamentals—aren't showing the average investor.

The Protocol's Pivot

Ethereum isn't just sitting still. The core development roadmap, often dismissed as 'vaporware' by cynics, is hitting tangible milestones. The shift from a monolithic to a modular architecture isn't tech jargon—it's a direct assault on the scalability trilemma that has capped its potential for years. Each successful upgrade silently strips away a barrier to mass adoption, building a runway for 2026 that most Layer 1 competitors can't match.

Institutional On-Ramps Are Live

Talk of institutional adoption is finally moving from conference panels to custody solutions. Major financial entities, having weathered the regulatory fog, are now building the plumbing. These aren't speculative bets; they're strategic infrastructure plays. When traditional finance finally connects its pipes to the Ethereum mainnet, liquidity won't trickle in—it will flood. The smart money always builds the canal before the rainy season.

The Application Layer Awakens

Price follows utility. Beyond DeFi and NFTs, the most compelling use cases—tokenized real-world assets, decentralized identity, on-chain gaming economies—are native to Ethereum's robust, battle-tested environment. Developers aren't just building apps; they're building economic systems. And in 2026, several of these systems are projected to hit critical mass, creating demand for ETH that transcends pure speculation.

A Cynical Note on the 'Narrative'

Let's be real: the market loves a story more than it loves code. The 2026 timeline conveniently aligns with the next Bitcoin halving cycle narrative—a coincidence that fund managers will happily use to justify positions they're taking for entirely different, technical reasons. Sometimes, a good story is just the包装 for a smart trade.

The bottom line? Ethereum's value proposition is quietly maturing from 'digital oil' to 'digital bedrock.' While short-term volatility will give pundits plenty to talk about, the underlying vectors point toward 2026 as a convergence point. The rally won't be sparked by a single headline; it will be fueled by years of groundwork finally hitting the ignition switch. Time to pay attention.

Ethereum price is quietly attracting more liquidity across derivatives, on-chain activity, and exchange flows, even as its price remains locked in a consolidation range. While ETH has struggled to produce a decisive breakout in recent weeks, underlying data suggests participation across the network is strengthening. This growing disconnect between improving fundamentals and muted price action is drawing close attention from traders, raising a key question: Is liquidity positioning ahead of a larger move, or simply building risk within the range?

Derivatives Positioning: Open Interest Continues to Climb

Data from CryptoQuant shows ethereum open interest rising steadily toward the $19–20 billion range, approaching recent highs. Importantly, this increase has occurred without a corresponding price expansion. For traders, rising open interest in a sideways market often signals positioning rather than trend confirmation. It suggests expectations are building for a larger directional move while also increasing the risk of volatility once the price breaks out of its current structure.

Exchange Reserves: Signs of Supply Tightening

Ethereum exchange reserves have trended lower over the same period, indicating a reduction in readily available sell-side supply. While short-term fluctuations remain, the broader picture points toward ETH being moved off exchanges rather than prepared for immediate liquidation. Historically, declining exchange balances tend to support price stability during periods of consolidation, especially when combined with rising derivatives participation.

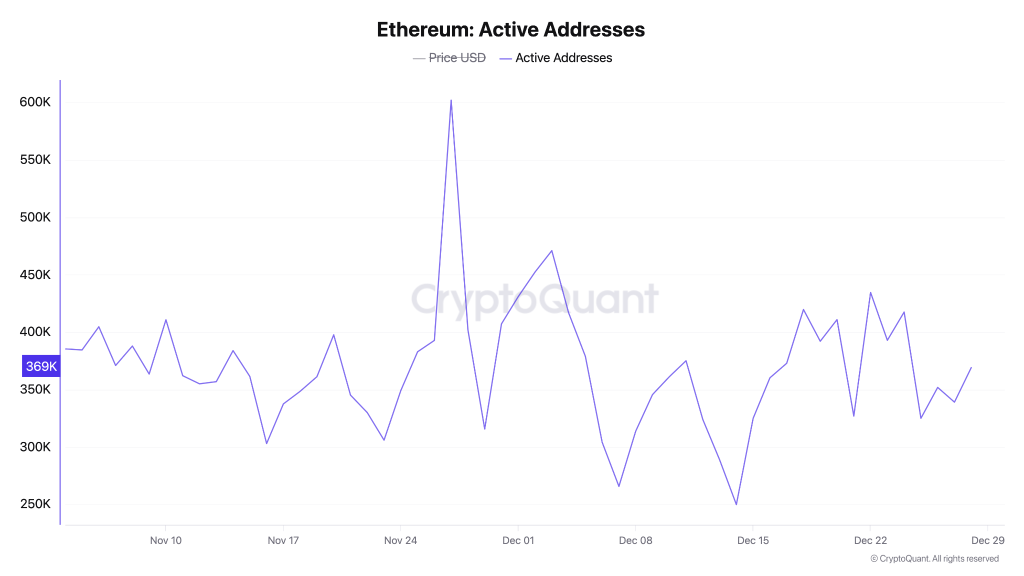

Network Activity: Active Addresses Remain Resilient

On-chain data shows Ethereum’s daily active addresses holding broadly within the 350,000 to 400,000 range, with periodic spikes higher. While activity has not accelerated sharply, it has also not broken down despite recent ethereum price weakness. This stability suggests continued network usage and participation. This reinforces the view that the current market phase reflects consolidation rather than demand erosion.

Ethereum Price Analysis: Compression Near Key Levels

The Ethereum price is moving within a tight range, forming higher lows while repeatedly facing resistance near the $3,200–$3,300 zone. This creates a clear compression pattern, where price is getting squeezed between rising support and horizontal resistance. Volatility has dropped sharply, which usually signals that a bigger move is coming. The RSI is holding near neutral levels, showing neither strong bullish nor bearish momentum yet. Overall, the chart suggests ETH is building pressure for a breakout rather than showing signs of weakness.

Conclusion: Liquidity Is Building, Confirmation Is Still Needed

Ethereum is approaching a decisive zone where improving liquidity metrics must translate into price confirmation. On the upside, a sustained break and acceptance above the $3,200–$3,300 resistance zone would validate the rising open interest and tightening exchange supply. If this level flips into support, the ETH price could open room for a move toward $3,500 initially, followed by a broader upside extension toward the $3,800–$4,000 range in early 2026.

On the downside, failure to hold the rising trendline support near $2,900–$3,000 would weaken the bullish setup and risk a deeper pullback toward $2,600–$2,550, where stronger demand is expected to re-emerge. Until either level breaks decisively, Ethereum remains in consolidation—but the compression suggests a larger directional move is building.