Bitcoin’s Fate Hangs in the Balance as Correlation With Japanese Yen Hits All-Time High

Bitcoin stands at a financial inflection point. Its price trajectory is now bizarrely—and unprecedentedly—tethered to the Japanese yen.

The Unlikely Dance Partner

Forget the S&P 500 or gold. The new chart mirror for crypto's flagship asset is a fiat currency caught in a decades-long deflationary spiral. Analysts are scrambling as the correlation coefficient between BTC and JPY smashes previous records, suggesting a shared sensitivity to global liquidity flows and risk sentiment that nobody saw coming.

Decoding the Signal

This isn't about Japan adopting Bitcoin as legal tender. It's a macro story. The yen has long been a proxy for the 'carry trade' and shifts in global risk appetite. When the Bank of Japan twitches, markets from Auckland to Zurich feel it. Now, Bitcoin is reacting in lockstep, behaving less like a speculative tech stock and more like a premier barometer of international capital movement—or just another asset drowning in the same liquidity pool.

The Fork in the Road

So, what's next? Path one: This correlation breaks as Bitcoin reasserts its unique, uncorrelated value proposition, decoupling to chart its own course based on adoption and halving cycles. Path two: The link tightens, further entangling crypto's narrative with the whims of central bank policymakers and forex traders—a crowd that still views digital assets as a sideshow, albeit a lucrative one.

The coming weeks will reveal whether Bitcoin is graduating to a macro asset or just finding a new, more traditional master to follow. After all, in high finance, every revolutionary asset eventually gets its own Bloomberg terminal ticker and a seat at the old boys' table—complete with the same old vulnerabilities.

After an impressive rebound during the first few days of 2026, Bitcoin (BTC) price has been rejected around $94k. The flagship coin dropped below $91k on Wednesday, January 7, amid rising midterm fear of further bearish impact from the unwinding Yen carry trade.

Bitcoin Suffers Liquidity Crunch Amid Unwinding of Yen Carry Trade

Bitcoin and the wider altcoin market are facing heightened short-term selling pressure as the Yen carry trade continues to unwind. The recent interest rate hikes by the Bank of Japan have caused investors to shift risk-off on crypto assets due to the unwinding of the Yen carry trade.

The liquidity outflow from bitcoin and altcoins to repay loans denominated in Yen weighed down on midterm bullish sentiment. During the December schedule, the BoJ increased its rate to 0.75%, thus making Yen loans less profitable at the global scale.

According to trading data from TradingView, BTC price closed in the fourth quarter of 2025 in a bearish outlook, amid strong global fundamentals, thus correlated with the Yen.

Source: X

Bitcoin’s liquidity outflow is clearly visible through the $243 million in cash outflows from the U.S. spot BTC ETFs.

Bigger Picture

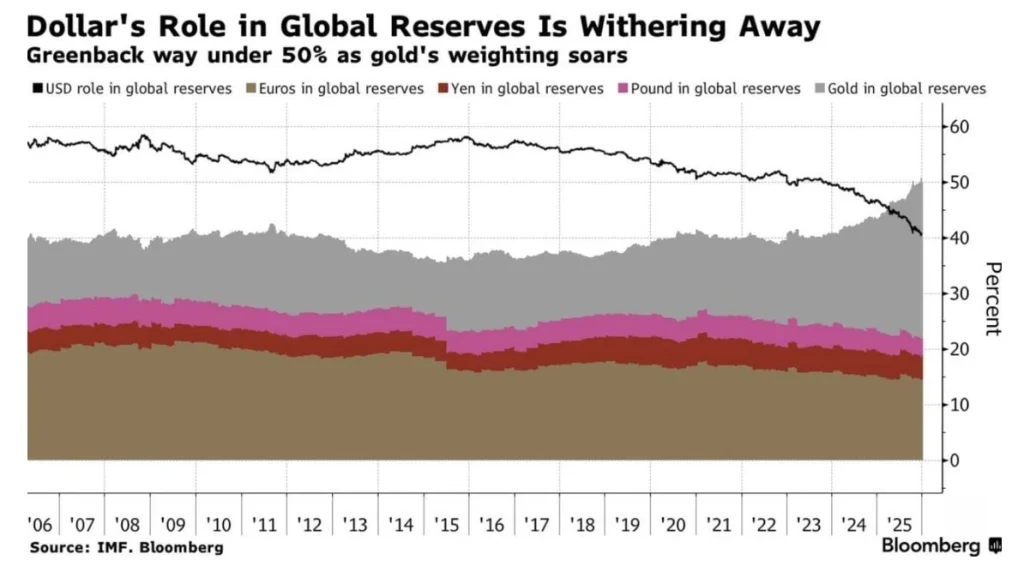

According to Tom Lee, a popular Wall Street analyst heavily invested in crypto, the parabolic rise of Gold in 2025 is an indicator of crypto bullish sentiment in 2026. According to Bloomberg data, the U.S. dollar was recently overtaken by Gold as the dominant global reserve.

Source: X

With Bitcoin adopted globally as a digital Gold, the flagship coin is well-positioned to rally exponentially in the coming months. Moreover, the ongoing Quantitative Easing (QE) by the Federal Reserve will trigger a risk-on investment mode in the NEAR future.