Bitcoin’s $2.9M Future: Decoding VanEck’s 25-Year Bull Case

Forget six figures. One asset manager just threw a nine-figure price target into the crypto arena.

The Long Game: A Quarter-Century Thesis

VanEck's forecast stretches to 2050, framing Bitcoin not as a quarterly trade, but as a generational shift. Their model hinges on Bitcoin capturing a slice of the global store-of-value market—think gold, but digital, programmable, and borderless. It's a bet on adoption curves, not hype cycles.

The Math Behind the Madness

The road to $2.9 million isn't paved with memes. It requires Bitcoin to become a foundational asset for sovereign wealth funds, corporations, and a new digital-native generation. Every percentage point of institutional allocation fuels the engine. The model assumes network effects will compound—slowly, then all at once.

Why This Time Is Different (They Say)

Past predictions crashed and burned. This one leans on structural change: clear regulatory frameworks, robust ETF infrastructure, and a hardening narrative as 'digital gold.' It's a vision where volatility smooths into steady, staggering growth—a comforting tale for pension funds, if you ignore the last decade's rollercoaster.

The Fine Print & The Friction

No forecast survives first contact with reality. Geopolitical shocks, black swan tech, and the ever-present specter of regulatory crackdowns could derail the train. And let's be honest—Wall Street's track record for long-term calls makes weather forecasters look like prophets.

Is $2.9 million a prophecy or a pipe dream? Either way, it forces the finance old guard to confront an uncomfortable truth: the future of money might not belong to them. They'll probably still charge a 2% management fee on it, though.

Matthew Sigel, VanEck’s head of digital assets research, and senior analyst Patrick Bush published the outlook on Wednesday. The price target is built on specific assumptions about how bitcoin fits into the global financial system over the next two decades.

How Does Bitcoin Get to $2.9 Million?

VanEck’s model rests on two big shifts.

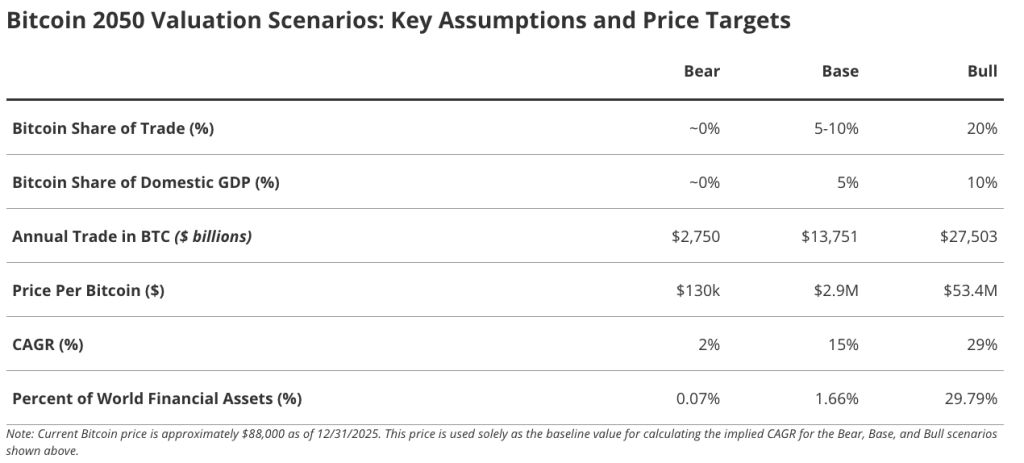

First, they expect Bitcoin to settle 5-10% of global international trade and 5% of domestic trade by 2050. To put that in context, the British pound currently handles about 7.4% of international payments. Bitcoin would need to reach similar territory.

Second, the firm projects central banks will hold 2.5% of their reserves in Bitcoin as trust in government debt erodes.

“Bitcoin is not a tactical trade in this framework; it functions as a long-duration hedge against adverse monetary regime outcomes,” the analysts wrote.

Three Scenarios, One Takeaway

VanEck mapped out bear, base, and bull cases.

The bear case lands at $130,000 with a 2% annual return. The base case hits $2.9 million at 15%. And a bull scenario pushes to $53.4 million at 29% annual growth, though that WOULD require Bitcoin to rival gold as a global reserve asset.

Here’s the interesting part: even VanEck’s worst-case scenario sits above Bitcoin’s current price of roughly $88,000.

What This Means for Investors

VanEck suggests putting 1-3% of a diversified portfolio into Bitcoin. Their data shows a 3% allocation to a traditional 60/40 portfolio historically produced the best risk-adjusted returns.

The firm’s bottom line is: “The cost of zero exposure to the most established non-sovereign reserve asset may now exceed the volatility risk of the position itself.”

Worth noting: this 15% growth assumption is actually down from VanEck’s December 2024 projection, which used 25%.