Polymarket Hack Exposed: Third-Party Vulnerability Drains User Funds in DeFi Security Wake-Up Call

Another day, another crypto hack—this time it's prediction market platform Polymarket bleeding funds through a third-party vulnerability. The breach highlights the persistent weak links in DeFi's security chain, where even the most sophisticated protocols can be undone by external dependencies.

The Attack Vector: Supply Chain Weakness

Attackers didn't directly assault Polymarket's core infrastructure. Instead, they exploited a vulnerability in a third-party service—a classic supply chain attack that bypassed primary defenses. The incident reveals how decentralized finance's interconnected ecosystem creates multiple points of failure, where one compromised component can cascade through the entire system.

User Funds in the Crosshairs

The exploit specifically targeted user funds, draining assets from accounts in what appears to be a calculated extraction. While the exact mechanism remains under investigation, the pattern suggests attackers identified and weaponized a permission or access flaw in the integrated service—a reminder that in crypto, your security is only as strong as your weakest partner's.

DeFi's Persistent Paradox

Polymarket's incident underscores DeFi's central contradiction: systems built on trustless technology remain vulnerable to very human engineering failures. The industry keeps building financial skyscrapers on foundations that still occasionally turn to sand—all while charging ahead toward the next innovation cycle.

The Aftermath and Industry Echoes

As Polymarket works to contain the damage and trace the stolen funds, the broader DeFi ecosystem faces familiar questions about security standards and third-party risk management. The hack serves as yet another stress test for an industry that somehow manages to treat billion-dollar breaches as learning experiences rather than existential threats—a luxury traditional finance lost centuries ago.

Until the industry starts treating security audits with the same enthusiasm as token launches, these incidents will keep providing expensive education. The real prediction market worth watching: how long until the next major breach proves this lesson still hasn't been learned.

Login Emails, Empty Accounts: Polymarket Users Describe Sudden Fund Losses

Reports of suspicious activity began circulating earlier this week on X and Reddit, where several users described receiving multiple login notification emails despite not attempting to access their accounts.

In multiple cases, users said they logged in hours later to find their positions closed and balances nearly zero.

One Reddit user wrote that three login attempts were flagged while their email and other online accounts showed no signs of compromise, adding that their Polymarket funds were drained at the same time the login emails were sent.

Another user provided a detailed account suggesting the breach may have involved weaknesses in the platform’s one-time password system at the time of the incident.

A bunch of people reporting their polymarket accounts using magic LINK were drained. Possibly an ongoing security issue with magic link (though can never rule out user error / phishing). A few from discord posted below but I've seen more reports. pic.twitter.com/hQkyzJdE6V

— Spreek (@spreekaway) December 23, 2025According to the user, the login codes were only three digits long and may have been vulnerable to brute-force attempts. The user noted that shortly after the incident, Polymarket appeared to increase the OTP length to six digits, though the company has not publicly commented on that specific claim.

if you have ever used or downloaded this @Polymarket trading bot, MOVE your funds to a new wallet immediately

this repo called simone46b/polymarket-trading-bot contains a malicious npm package called polystream/streaming, it pretends to be a sha256 validation utility, but it is…

User reports have pointed to a common thread among affected accounts. Several said they had signed up through Magic Labs, a popular onboarding service that allows users to log in with email addresses and automatically creates non-custodial ethereum wallets.

Magic Labs is widely used by newer crypto users who do not already manage their own wallets.

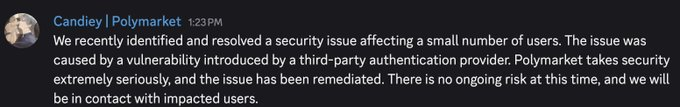

While Polymarket did not name the authentication provider involved, it acknowledged in a message posted to its official Discord channel that the vulnerability originated from a third-party service.

The platform said it WOULD contact impacted users directly but did not offer details on reimbursements or recovery options.

Third-Party Breaches Keep Haunting Crypto Platforms

The incident is not the first time Polymarket has faced security-related concerns tied to external services.

In September 2024, users who logged in through Google accounts reported wallet drains involving unauthorized proxy transactions that moved USDC funds to phishing addresses.

At the time, Polymarket investigated the events as potentially targeted exploits linked to third-party authentication tools.

More recently, a phishing campaign that abused the platform’s comment sections resulted in losses exceeding $500,000 after users were redirected to fake login pages.

The breach comes amid a broader rise in third-party security failures across the crypto and technology sectors. This week, crypto tax software firm Koinly warned users that email addresses may have been exposed following a breach at Mixpanel, an analytics provider it previously used.

![]() @KoinlyOfficial warns a third-party breach may have exposed user emails but stresses that no wallet, transaction, tax, or portfolio data was shared with Mixpanel.#CryptoSecurity #CryptoTax #Koinlyhttps://t.co/ASDxMchfyg

@KoinlyOfficial warns a third-party breach may have exposed user emails but stresses that no wallet, transaction, tax, or portfolio data was shared with Mixpanel.#CryptoSecurity #CryptoTax #Koinlyhttps://t.co/ASDxMchfyg

Koinly reported that no financial/tax information had been breached and that it no longer uses the service.

Elsewhere, Swiss crypto platform SwissBorg released a report of a loss of 41 million earlier this year following a compromise by attackers of an API provider, and Discord and a number of DeFi protocols have also reported attacks related to external vendors.

![]() SwissBorg hit by $41.5M $SOL hack after API compromise amid cascade of crypto security failures, including Nemo and Aqua exploits.#CryptoHack #Solanahttps://t.co/ztUl2s0yxv

SwissBorg hit by $41.5M $SOL hack after API compromise amid cascade of crypto security failures, including Nemo and Aqua exploits.#CryptoHack #Solanahttps://t.co/ztUl2s0yxv

A consistent warning that security researchers have given is that the use of third-party infrastructure can increase attack surfaces, particularly with crypto platforms growing.