Solana Price Prediction 2026: Early Flows Show SOL Outshining Bitcoin – Can SOL Actually Overtake BTC?

Solana isn't just rallying—it's stealing the spotlight. Fresh 2026 capital flows reveal a stark trend: investors are piling into SOL at a pace that's leaving Bitcoin in the digital dust. The question on every trader's screen is no longer about if Solana will grow, but how high it can climb relative to the old guard.

The Speed vs. Store of Value Showdown

Bitcoin built the cathedral, but Solana's building the highway right next to it. While BTC maintains its throne as digital gold, SOL's throughput and lower costs are attracting a different breed of capital—the kind that values utility over pure narrative. Early-year institutional allocations hint at a portfolio rebalancing that favors scalable blockchains, a move that quietly sidelines the 'store of value' thesis for a 'use it or lose it' reality.

Network Activity as the True North Star

Forget vague promises; follow the transactions. Solana's developer activity and dApp engagement metrics are painting a picture of a network that's being used, not just hoarded. This fundamental shift from speculative asset to functional ecosystem is what's driving these early 2026 flows. It's the difference between betting on a vault and betting on a city.

The Flippening Fantasy Meets Cold, Hard Math

Can SOL's market cap ever truly overtake Bitcoin's? On pure momentum, the gap is closing in certain metrics. But surpassing BTC would require a seismic shift in global crypto perception—a move from a singular, monolithic benchmark to a multi-chain future. Some hedge funds are already positioning for this divergence, treating them as entirely different asset classes. After all, in traditional finance, nobody asks if Visa will overtake gold—they just collect fees from both.

The path forward isn't about one killing the other. It's about Solana proving that in the next cycle, speed and scalability might just attract more capital than legacy alone. The early money is voting with its wallet. The rest of the market, as always, will follow the returns—with the usual lag and a hefty management fee.

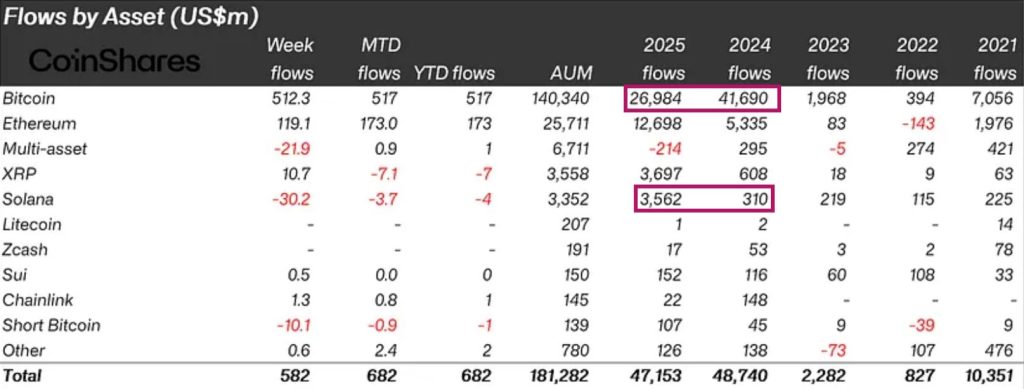

Solana outperforms in year-over-year inflows. Source: Coinshares.

Solana outperforms in year-over-year inflows. Source: Coinshares.

Although Bitcoin dominance ROSE during the long 2025 consolidation, investor appetite for altcoins never disappeared.

With sentiment now shifting, conditions are forming for a potential altcoin season, and Solana is positioning itself as the frontrunner.

Solana Price Analysis: Can SOL Overtake BTC?

The 2025 consolidation materialized as a descending triangle structure, which could now be on the breakout path as sentiment drives fresh inflows.

Momentum indicators reflect the shift.

The RSI has made a decisive cross above the 50 neutral line, at levels unseen since September at 57, before geopolitical uncertainty plunged the market into extreme fear conditions.

The MACD reads much the same with a wide lead above the signal line, suggesting bulls are back in control of the prevailing trend.

This bullish backdrop affirms the lower boundary of the triangle as a launchpad yet again, and with it, a breakout push may be underway.

The key breakout threshold is strong December resistance at $210. If flipped back into support, it could act as a firmer and higher footing for a confirmed 265% breakout push to $500.

And as the bull market matures and bullish sentiment grows, fundamental catalysts like the Alpenglow upgrade could push a bigger 625% MOVE to $1000.

Still, while it is credible that Solana could go on to outperform Bitcoin again this year, flipping it in market cap is a distant goal.

Bitcoin Hyper: Bitcoin Could Still Beat Out Solana

Those who chose Solana as an alternative to the leading cryptocurrency may need to reconsider, as the Bitcoin ecosystem finally tackles its biggest limitation: scalability.

Bitcoin Hyper ($HYPER) is bridging Bitcoin’s security with Solana tech, creating a new Layer-2 network that unlocks scalable, efficient use cases Bitcoin couldn’t support on its own.

Whatever Solana does, Bitcoin will soon be able to do too.

The project has already raised over $30 million in presale, and post-launch, even a small fraction of Bitcoin’s massive trading volume could send its valuation significantly higher.

Bitcoin Hyper is fixing the slow transactions, high fees, and limited programmability that have long capped Bitcoin’s potential – just as the market turns bullish.

Investors appear to be shifting capital toward select altcoins and high-conviction opportunities, while remaining cautious with Bitcoin.

Visit the Official Bitcoin Hyper Website Here