Bitcoin Wipes Out 2025 Gains: Is This Year Already a Dud?

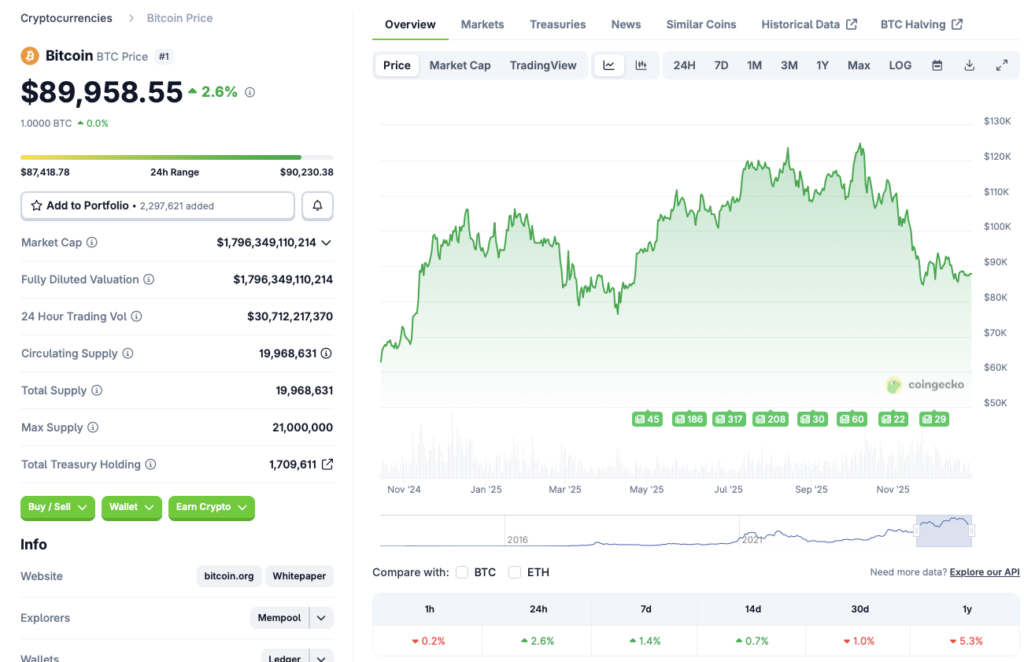

Bitcoin just erased every shred of progress it made this year. The digital gold narrative is looking a bit tarnished as prices slide back to where 2025 began.

The Great Reset

Markets don't care about your calendar. The flagship cryptocurrency's plunge serves as a brutal reminder that past performance guarantees nothing—a concept Wall Street veterans pretend to understand right before the next crash.

Searching for a Bottom

With yearly gains vaporized, traders are scrambling. Is this a healthy correction or the start of something uglier? The charts show a clear breakdown, but conviction is in short supply.

What's Next for Crypto?

Forget moon shots; the conversation has shifted to damage control. Can Bitcoin find a floor, or will it drag the entire digital asset class lower? The next move will separate the believers from the tourists.

One thing's certain: in crypto, a year's work can disappear faster than a hedge fund's ethics. The only question left is who's buying the dip—and who's just buying time.

Source: CoinGecko

Source: CoinGecko

Was 2025 a Dud Year For Bitcoin, And Will 2026 Be Different?

While 2025 may be ending in a way not many envisioned, the year sure did have some memorable milestones. bitcoin (BTC), in particular, had quite an incredible start to the year. Apart from hitting a new all-time high in 2025, BTC also saw mass adoption in the form of ETF inflows and corporate treasury buys. The original crypto is expected to continue seeing more adoption from corporate treasuries in the coming years.

The market correction over the last few months was unprecedented. Macroeconomic uncertainties and the low chances of another interest rate cut in the coming months has led to a substantial exodus of investors from risky assets, such as cryptocurrencies.

2026 may be different from 2025. In fact, we may see Bitcoin (BTC) go even higher than its 2025 peak. According to Bernstein, BTC could climb to a new peak of $150,000 next year. Grayscale also presents a bullish outlook for BTC in 2026. Both financial institutions claim that BTC is following a 5-year cycle, and not a 4-year path. This means that the asset will climb to a new high next year before facing a dip (five years after the 2021 peak).