Monero Shatters Records: XMR’s Meteoric Rise Puts Top 10 Crypto Ranking in Sight

Monero just blasted through its previous ceiling—and the privacy-focused coin isn't slowing down. This isn't just another pump; it's a statement. While mainstream finance still debates transparency, a growing cohort is voting with their wallets for something else entirely: financial sovereignty.

The Stealth Ascent

Forget the predictable charts of blue-chip tokens. Monero's climb looks different. It doesn't follow; it diverges. The network's core promise—untraceable, fungible transactions—resonates in an era of increasing surveillance. Every transaction is obfuscated by default, cutting a clean path through the blockchain's permanent ledger. It's digital cash that actually behaves like cash.

Market Mechanics & The Top 10 Threshold

Hitting a new all-time high recalibrates the entire market calculus. It resets resistance levels and redraws the psychological map for traders. The chatter now isn't just about price discovery—it's about market cap and the looming shadow over the current Top 10. To break in, XMR needs to displace an incumbent. That list is a fortress of established platforms and payment giants, but fortresses have been breached before by simpler, sharper ideas.

The real fuel here isn't just speculative fervor. It's adoption. Real-world use for private transactions creates a demand floor that hype alone can't sustain. While some chains tout transaction speed, Monero sells something more primal: discretion. In a world where every Starbucks purchase is data-mined, that's a powerful feature—not a bug.

A Provocative Prospect

Could a privacy coin really sit at crypto's top table alongside the likes of Bitcoin and Ethereum? The purists would scoff, citing regulatory headwinds. The pragmatists would note that demand has a funny way of bending rules. Centralized exchanges may fret, but decentralized protocols don't ask for permission. If the trend holds, the market's hierarchy faces a direct challenge from an asset built to operate outside traditional hierarchies.

One thing's clear: the narrative that privacy is a niche concern is crumbling. Monero's new peak is a data point that Wall Street's compliance bots probably flagged with extreme prejudice. After all, what's the point of a perfectly transparent ledger if it just makes tax season easier for the suits?

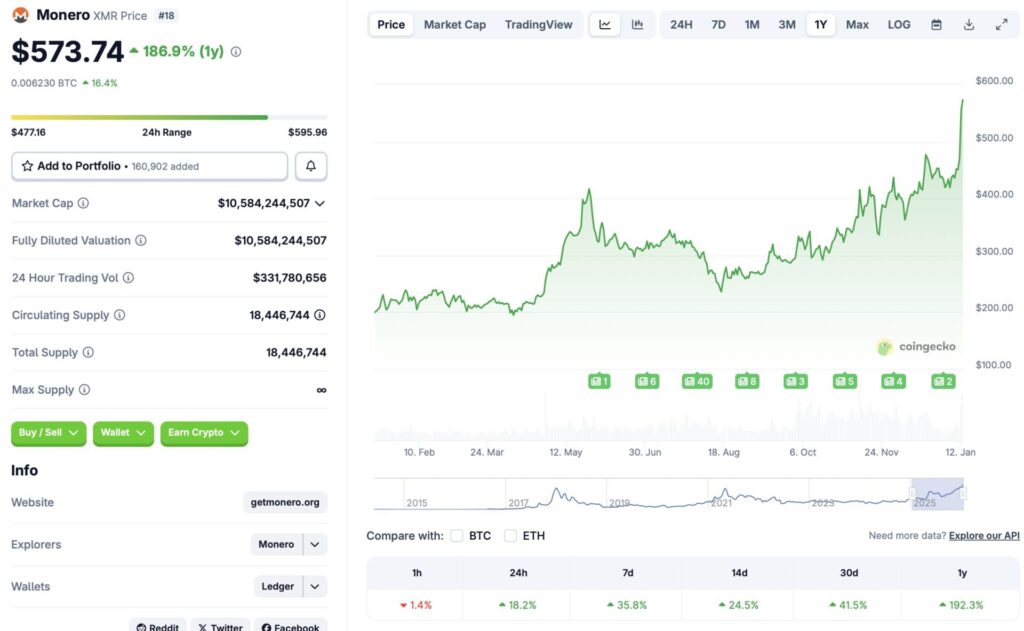

Source: CoinGecko

Source: CoinGecko

Will Monero (XMR) Continue Rallying And Enter The Top 10?

Monero’s (XMR) climb to a new all-time high has pushed the project’s market cap to $10.58 billion. XMR is currently the 18th largest crypto project by market cap. If the asset continues its current trajectory, it could easily enter the top 10 projects.

Monero’s (XMR) turned bullish in late 2025, while other assets were facing price dips. In fact, the market saw a surge in the value of privacy-focussed cryptocurrencies late last year. The development may have been due to increased interest in anonymity.

Monero (XMR) hitting a new all-time high could be due to Zcash (ZEC) investors moving their funds to XMR after ZEC saw an exodus of developers. The core development team at ZEC, Electric Coin Company (ECC), earlier this month due to internal conflicts. ECC is currently working on a new project that aims to continue ZCash’s mission. ZEC’s downfall is the likely reason for Monero’s (XMR) incredible rally today.

According to CoinCodex data, Monero’s (XMR) price will continue surging over the coming months. The platform anticipates the asset to hit multiple all-time highs in the first quarter of 2026. CoinCodex predicts XMR will trade at a peak of $847.92 on April 10, 2026. Hitting $847.92 from current price levels will entail a rally of about 47.8%.