zkPass Price Surges: Can ZKP’s Rally Hold or Is a Fall Inevitable?

ZKP rockets upward—again. The question on every trader's screen isn't if it went up, but whether the climb has legs or if gravity's about to kick in.

The Momentum Play

Today's surge isn't happening in a vacuum. It's feeding off a broader crypto rally, where narratives around privacy and scalable verification are back in vogue. zkPass, positioning itself at that intersection, is catching the wave. The protocol's core promise—proving your data is valid without revealing the data itself—hits a sweet spot for institutions dipping toes back into digital assets.

The Skeptic's Corner

Let's be real: the crypto market has the memory of a goldfish and the patience of a day trader. A single green candle can trigger a frenzy of 'this time it's different' optimism, often followed by the sound of profit-taking alarms. Every surge plants the seed for its own correction. It's the market's version of a perpetual motion machine, powered entirely by other people's money and hopium.

Technical Tells & Market Sentiment

Watch the volume. A price pump on thin volume is a party with no guests—it won't last. The key is whether buying pressure is sustained or if it's just a few large wallets playing ping-pong with the order book. Support levels from the previous consolidation phase will now act as the critical floor. If ZKP holds above them, bulls breathe easier. A break below, and the 'buy the dip' crowd might get quiet fast.

So, will ZKP hold the line or get swept back down? In crypto, the only certainty is volatility. Today's rally is a statement; tomorrow's chart will be the verdict. Just remember, in traditional finance, they call this 'speculation' and charge you a management fee for it.

Factors Responsible for ZKP's Price Surge

Listings on Upbit and Bithumb

It was listed on Upbit and Bithumb on December 26, 2025. These two are two of the biggest South Korean exchanges. By being listed on these two platforms, ZKP was able to gain more liquidity and more recognition, especially within the Asian market. Being listed on Upbit, which exceeds $1.2 billion each day, improves the recognition of zkPass.

The effect of being listed on major exchanges is that prices rise due to accessibility of the token. The other reason is that demand increases, and therefore there is a rapid price rise, which we've witnessed in this token

Binance Trading Competition

It also participates in the Binance BNB Smart Chain Trading Competition, which commenced on December 23 and will end on January 6. The reward in this competition is 1.25 million ZKP tokens. This has led to an increase in trading volume of 280.59%, thus alleviating sell pressure.

This competition causes an increase in purchase behavior, thus an increase in price. Additionally, Binance’s promotion of private projects such as zkPass lends credibility to the token, thus pulling in traders.

Recovery from Airdrop Sell

After the airdrop that occurred on December 19, there was a sell-off of cryptocurrency by the holders to make gains. However, things have changed, and it seems that the ZKP price has begun to recover. The Fear & Greed Index has increased from 21 to 27.

A change in sentiment that is accompanied by a sell-off is a signal for a revival, and this is what evident in this altcoin, where the selling pressure has eased.

ZKP Price Analysis: What's Happening After Listing?

ZKP was officially listed on the exchanges on the 19th of December, but it has had its share of ups and downs in the market. There was a price decline of 25% in the beginning as many people sold their airdrop tokens, but it is getting better.

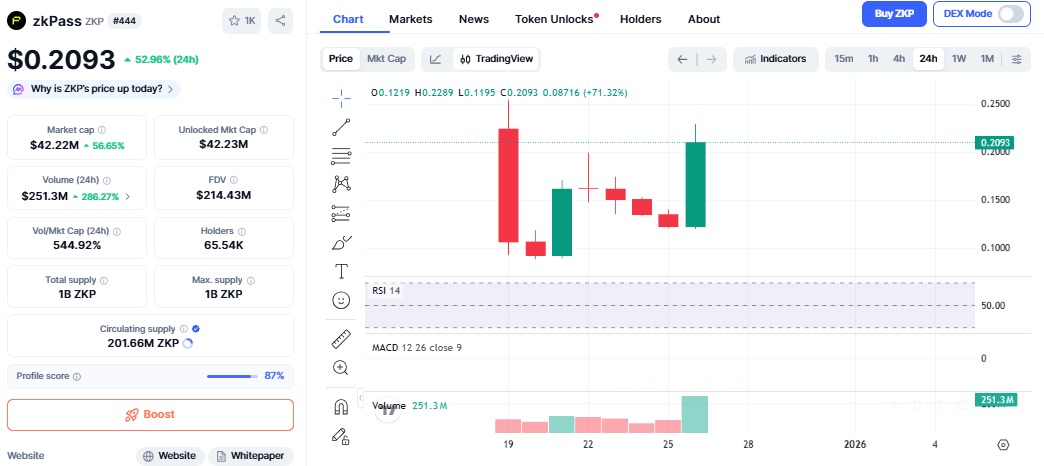

Source: CoinMarketCap Chart

The graph suggests that the token is displaying a bullish signal.

RSI at 14, indicating the token was previously oversold. The recent price surge suggests a potential recovery from this condition.

MACD is also showing positive signals of purchase.

It is currently testing the resistance level of $0.22. If it can break out past it, it might MOVE to $0.25. But the final round in the Binance competition might result in profit taking. This could then create a temporary downturn.

Can ZKP Continue Its Rally?

Falling institutional it's rapid growth is primarily fueled by listings on exchanges and the Binance competition. These exercises have generated greater interest in ZKP and subsequently greater trade volumes.

It should be noted that after events such as the Binance competition, there is usually a period of profit-taking, where traders realize their gains in cash, leading to possible corrections. If the token can sustain itself above $0.18, the token can move further up. Breaking past $0.22 levels can take the token to $0.25 or even further. However, if the selling escalates, a slight correction can be expected.

This article is for informational purposes only and not a financial advice, kindly do your own research before investing in the crypto market.