Coinbase’s Stablecoin Rewards Ignite CLARITY Act Battle—Here’s Why It Matters

Coinbase just threw a regulatory grenade—and Washington is scrambling. The exchange’s move to offer yield on stablecoin holdings has become the unexpected flashpoint in the fight over the CLARITY Act, a bill that could reshape crypto’s future in America.

The High-Stakes Standoff

At its core, the clash pits a straightforward user incentive against a decades-old regulatory framework. Coinbase’s program lets customers earn returns on idle dollar-pegged tokens—a feature common in decentralized finance but now hitting Main Street via a publicly-traded giant. Regulators see a security; the industry sees innovation. Neither side is blinking.

Why CLARITY Can’t Look Away

The bill’s architects now face a real-time test case. Does rewarding stablecoin holders constitute an investment contract? If so, every savings-like product in crypto might need a securities license—slamming the brakes on an entire ecosystem. Opponents argue it’s just digital banking; proponents warn of unchecked risk. The debate’s gotten so heated that one Senate staffer called it “the crypto version of redefining a savings account.”

The Ripple Effect

Beyond the legal jargon, the outcome could dictate where everyday Americans park their digital dollars. Fail to clarify the rules, and innovation shifts offshore—taking liquidity and tax revenue with it. Get it right, and the U.S. might finally provide the certainty needed for stablecoins to thrive as a legitimate financial tool. Of course, in traditional finance, they’d just charge you a monthly fee and call it a feature.

Watch this space. How D.C. responds to Coinbase’s gambit will signal whether the U.S. is building a framework for the future—or clinging to a playbook from the past.

According to the report published on January 11, 2026, by Bloomberg, the U.S. largest crypto trading platform has warned to withdraw support for the bill if it restricts its ability to offer rewards on stablecoin staking.

With Senate action expected within days, could this single issue delay U.S. crypto regulation again?

Why Is the Matter Heating Up? The Reasons Behind

The dispute comes just months after the GENIUS Act became law in July 2025. It is a first federal infrastructure created for stablecoins regulated management, states fully backed reserves, audits, and strong consumer protections.

Importantly, the GENIUS Act bans stablecoin offering platforms, such as Circle, from giving interest or yield directly to stakers. However, it does not ban third-party platforms from offering rewards, under which Coinbase is allowed to share interest earned on stablecoin reserves with its users.

The exchange currently offers around 3–4% rewards on USDC balances held on the platform. For Coinbase, these rewards are not a side characteristic, they contribute as an important source of revenue for the company and a key benefit for customers.

However, banking groups like American Bankers Association argue that stablecoin rewards:

Pull deposits out of traditional banks

Reduce lending to small businesses and homebuyers

Create unfair competition because crypto platforms lack FDIC insurance

Thus they want this stopped and are lobbying lawmakers to close the loophole in the new crypto bill.

Coinbase Says This Is About Competition, Not Risk

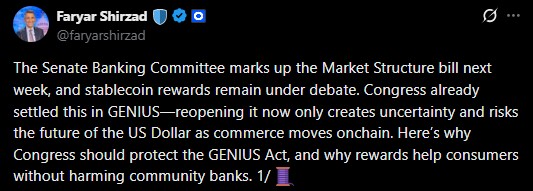

Coinbase strongly rejects the banking industry’s claims. Chief Policy Officer Faryar Shirzad has framed the debate as a competition issue, not a financial stability concern.

According to Coinbase, restricting its stable coin rewards WOULD raise costs for consumers, reduce choice, and weaken the U.S. payments system.

The company also argues that banning rewards could hurt U.S. dollar dominance in digital assets, especially as China began paying interest on its digital yuan starting January 1, 2026.

Coinbase has been a vocal supporter of pro-crypto legislation and a major political donor, but reports suggest it is willing to walk away from the bill if rewards are severely restricted.

Impacts of This Dispute — Delay!

The debate over crypto rewards is now starting to weaken support from both political parties for the wider crypto market-structure bill. While the administration wants the bill passed quickly, senators are facing a tough choice: MOVE fast or risk the entire bill falling apart because of one controversial issue.

Some lawmakers are looking for a compromise. One idea is to allow rewards only if users actively do something, such as staking or locking their funds, instead of earning returns just by holding stablecoins. However, it is still uncertain whether this approach would win enough votes in the Senate.

Effects on Crypto Market

Staking is one of the most popular features nowadays. Since the GENIUS Act came into effect, stablecoins adoption has surged with total market value is now above $300 billion. Regulatory clarity brings trust and leads growth in stablecoin payments, DeFi, and on-chain settlement.

If Coinbase stablecoin rewards survive in some form, U.S. platforms may continue attracting more users and capital. If banks succeed in shutting them down completely, activity could shift toward offshore issuers and non-U.S. platforms.

At its core, this fight is about who benefits from interest on stablecoin reserves, banks, platforms, issuers, or everyday users.