Tokenized Gold on XRPL Surges as Community Greenlights Major Launch

Digital gold just got a blockchain backbone—and the market's biting.

The XRP Ledger's tokenized gold ecosystem is exploding. Forget dusty vaults and paper certificates; this is precious metals moving at internet speed. A groundswell of community consensus has officially triggered the launch phase, signaling a massive vote of confidence in blockchain's ability to redefine asset ownership.

Why This Isn't Just Another Crypto Gimmick

This isn't speculative vaporware. Each digital token is pegged to real, physical gold held in reserve. The XRPL's native efficiency—think lightning-fast settlements and negligible fees—cuts out the traditional financial middlemen who've been skimming off the top for centuries. It bypasses the sluggish, paper-based systems that have long plagued commodity trading.

The community's decisive move to launch isn't just a technical milestone; it's a market signal. It shows that demand for tangible, inflation-resistant assets is converging with the demand for digital, borderless utility. Suddenly, storing and transferring value looks less like a visit to a bank and more like sending an email.

A New Gold Standard?

The play is clear: merge the timeless trust of gold with the radical efficiency of blockchain. The result? An asset that's as solid as bullion but as fluid as a meme coin. For the crypto-savvy investor, it's a hedge. For the finance traditionalist, it's a gateway. And for the system? It's a quiet revolution—one that asks why we ever settled for storage fees and settlement delays in the first place. After all, Wall Street never liked giving up its golden goose, even when that goose was sitting in a vault doing nothing.

So watch this space. The fusion of hard assets and decentralized ledgers is heating up, proving that sometimes the oldest stores of value need the newest technology to truly shine. Just don't expect your old-school broker to understand it—they're probably still trying to figure out their fax machine.

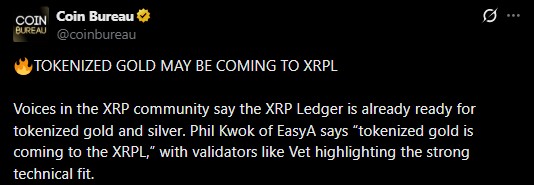

Phil Kwok, co-founder of Web3 education platform EasyA, recently stated that “tokenized gold is coming to the XRPL,” a comment that quickly spread across the community.

It’s less about “first launch” and more about growth, scale, and future opportunities in the booming real-world asset (RWA) market.

Chain-Based Gold Is Not Entirely New on XRPL

While the recent buzz suggests something new may be approaching, tokenized gold already exists on the XRP-Ledger. In 2024, Ripple partnered with an Australian tokenization platform named Meld-Gold, to launch digital tokens on XRPL.

Here each digitized token represents one gram of physical metal which is fully backed and claimable through regulated custodians like MKS Pamp and Imperial Vaults.

The current buzz is widely seen as a result of renewed momentum, increasing demand, or the possibility of additional projects opening more doors for growth in 2026.

Why Tokenized Bullion Is Seen as a Strong Fit for XRP

Influencers like Phil Kwok highlight XRPL’s readiness which makes it a perfect choice for handling precious metals trading.

XRP Ledger validators agree with this view, pointing to the ledger’s ability to handle fast settlement, 24/7 operation, built-in decentralized exchange features, and automated market makers. These features make XRPL attractive for shared ownership, real-time transfers, and auditable trading of physical assets.

On the other hand, from a market perspective, tokenized-gold strengthens XRPL’s role as a serious RWA infrastructure, not just a payment ledger.

Growing Demand: On-Chain Bullion Into RWA Boom

The increasing attention in on-chain commodities come as the real-world asset (RWA) tokenization market crossed the $35 billion level in late 2025. Beyond yield-based RWAs, interest is expanding into commodities, metals, and tangible stores of value.

On-chain ownership allows customers to trade fractions of physical metal, instant settlement without the need for third parties, and an ease of global access. These benefits align closely with XRP ledger’s development motives, significantly expanding its role beyond payments into asset management and commodities trading.

For now, one thing is clear: tokenized-gold is once again in the headlines, and XRP Ledger is potentially positioned in the relation as a blockchain ready for real-world assets' mass adoption.