Zcash Explodes: Why $ZEC Is Surging Today & What Comes Next Against Monero’s Rally

Zcash just ripped through the charts. The privacy coin isn't just moving—it's on a tear, leaving traders scrambling and the broader market watching. But what's fueling this sudden surge, and can it hold its ground against Monero's own powerful momentum?

The Catalyst Behind the Pump

Forget vague speculation. This rally has concrete drivers. Major exchange integrations finally went live, pouring fresh liquidity into the $ZEC pool. Institutional whispers about privacy tech as the next regulatory hedge are growing louder. Meanwhile, a critical network upgrade just activated, slashing transaction fees and boosting throughput. It's a perfect storm of utility meeting demand.

ZEC vs. XMR: The Privacy Showdown Heats Up

This isn't happening in a vacuum. Monero's been climbing steadily, a slow-burn testament to its hardened, privacy-by-default ethos. Zcash's approach—selective transparency with its shielded pools—offers a different value prop. It's the compliant privacy play, the one that might just wink at regulators while keeping your transactions hidden. The market isn't choosing one winner; it's betting on the entire sector. As one fund manager dryly noted, 'In a world of surveillance, even Wall Street wants a little deniability.'

What's Next for the ZEC Rally?

Technical ceilings loom, but the momentum is undeniable. Watch the key resistance levels. A clean break could signal a sustained re-rating, not just a pump. The real test? Whether the new user influx sticks around for the tech, or just the quick gains. This surge has put privacy coins back on the front page. Now, they have to prove they belong there.

The trading volume tells an even bigger story. Its trading volume has jumped 25% to $686.46M. This fall and rise pattern is one of the major reasons why many see today’s MOVE as the start of a $ZEC recovery rally 2026.

The Privacy Coin Rally: Zcash Went Up and Monero Surging?

The rise is not happening alone. Experts across the crypto community are comparing $ZEC and Monero again. Lately, whales have been shifting their money around. As one popular expert recently put it:

“When conviction fades, capital moves. And in the world of privacy, that shift looks like whales exiting the current trending token and leaning harder into Monero.”

Right now, Zcash's price is at $397, while Monero is trading NEAR $576. Many still believe 2026 is the year of the Zcash privacy coin rally. Even with $XMR showing more strength, today’s analysis shows that people are starting to trust this coin again as a major player for 2026 breakout.

Why Is Zcash Pumping Today Based on Technical Chart Signals

On the ZEC/USDC 3-hour chart TradingView price chart, it has broken its steady downtrend by bouncing from the $370–$380 demand zone.

Buyers defended this area strongly and pushed the price back toward $395–$400 levels. Here is what traders need to watch next:

This is a key decision zone.

-

Holding above $400 = strength

-

Rejection below $400 = relief bounce only

RSI is now near 47, recovering from oversold levels near 30, which is also why $ZEC is going up right now. MACD is also turning positive. It is not a full reversal yet, but it shows an early ZEC recovery rally.

This price bounce and technical reasons explain today’s price pump despite weak weekly performance.

The Roadblock: Will Zcash Price Rally Continue or Stall Soon?

While today is a win-win situation, it doesn't confirm the long-term clear trend yet. The asset is now facing resistance near $410–$420. If price breaks and holds above this, the next targets are $440–$450.

On the other hand, If it falls below $385, the weakness may return back. The next support WOULD be $370, and below that, $350 becomes possible.

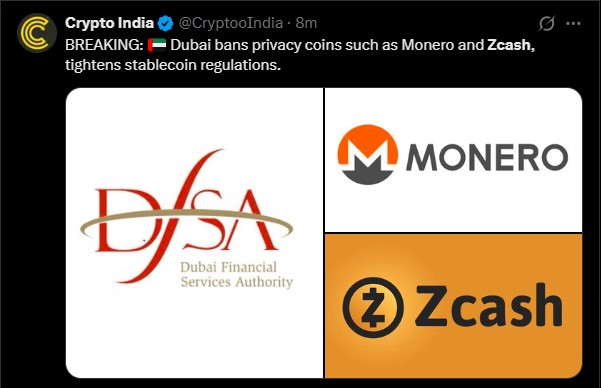

As per Crypto India’s latest X post, Dubai has banned privacy coins like Zcash and Monero and tightened stablecoin rules. Such news adds risk, but today’s price action shows that traders are focusing more on technical recovery than fear headlines.

Traders should note that current market structure shows the privacy coin is in trend stabilization, not a confirmed bullish setup yet.

Zcash(ZEC) Price Prediction 2026: Coming Targets You Should Watch

Short term: After analyzing the technical and fundamental reasons behind why is Zcash pumping today, If it holds above $400, it can move toward $410–$420 and $440. A fall below $385 may push it back to $370.

Mid term: The asset must stay above $400 and FORM higher lows to target $450–$480. Otherwise, it may range between $350–$420.

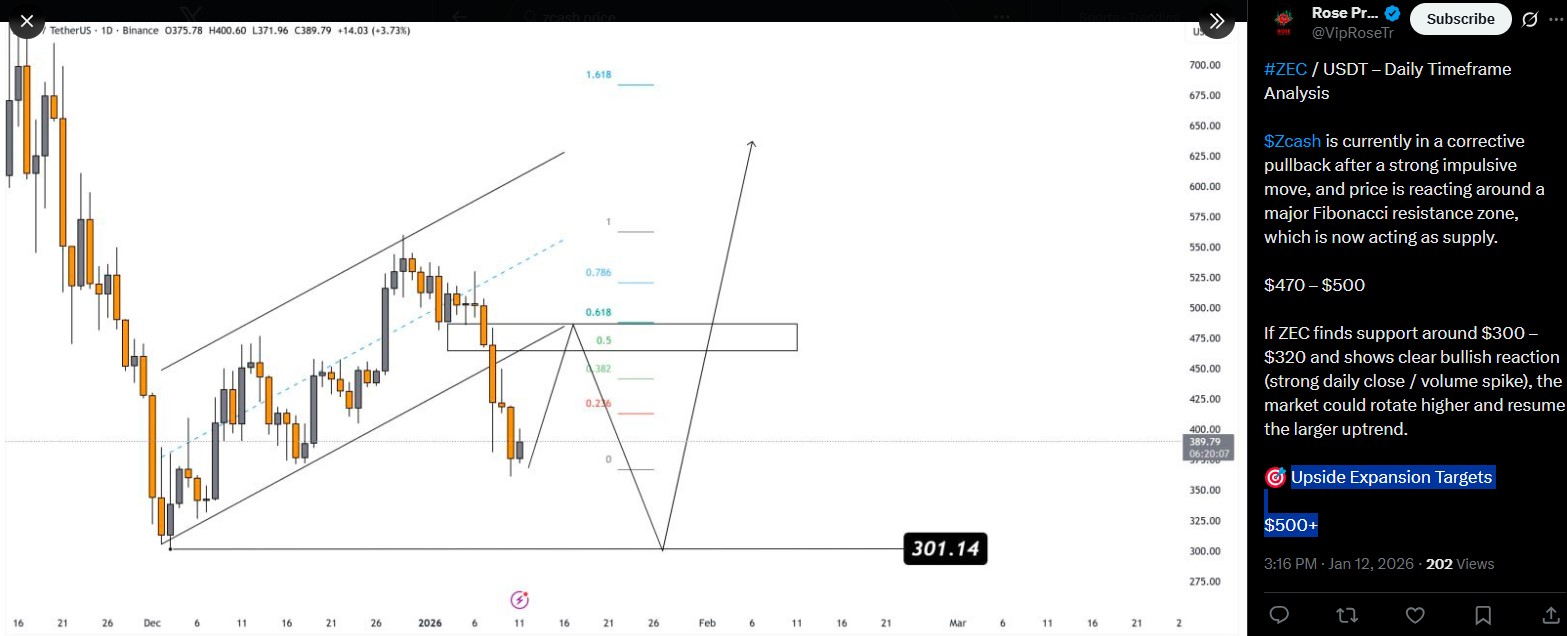

Long term: It could aim for $550–$600 in a full recovery cycle. Analysts like ROSE Premium Signals say ZEC is reacting to a Fibonacci resistance zone, with upside expansion targets above $500. While on the other side, Monero XMR price prediction remains stronger, with long-term targets above $1,000 and even $1,650.

Conclusion

So, Why Is Zcash Pumping Today? Because selling pressure is fading, volume is rising, and buyers are testing key levels. $ZEC price surge does not confirm bullish behaviour, but surely it is no longer in panic mode.

Market structure shows it is moving from fear into stabilization. Traders should keep a close eye on the $400 support level to confirm the upcoming price behaviour, and patterns forming on the charts.

YMYL Disclaimer: This article is for educational purposes only and does not constitute financial advice. Cryptocurrency markets are highly volatile. Always do your own research (DYOR) before making any investment decisions.