U.S. Economy Defies Expectations, Yet Peter Schiff Spots a Dangerous Crack in the Foundation

Numbers flash green—growth beats forecasts, markets cheer. Then a veteran voice cuts through the noise with a warning that turns optimism cold.

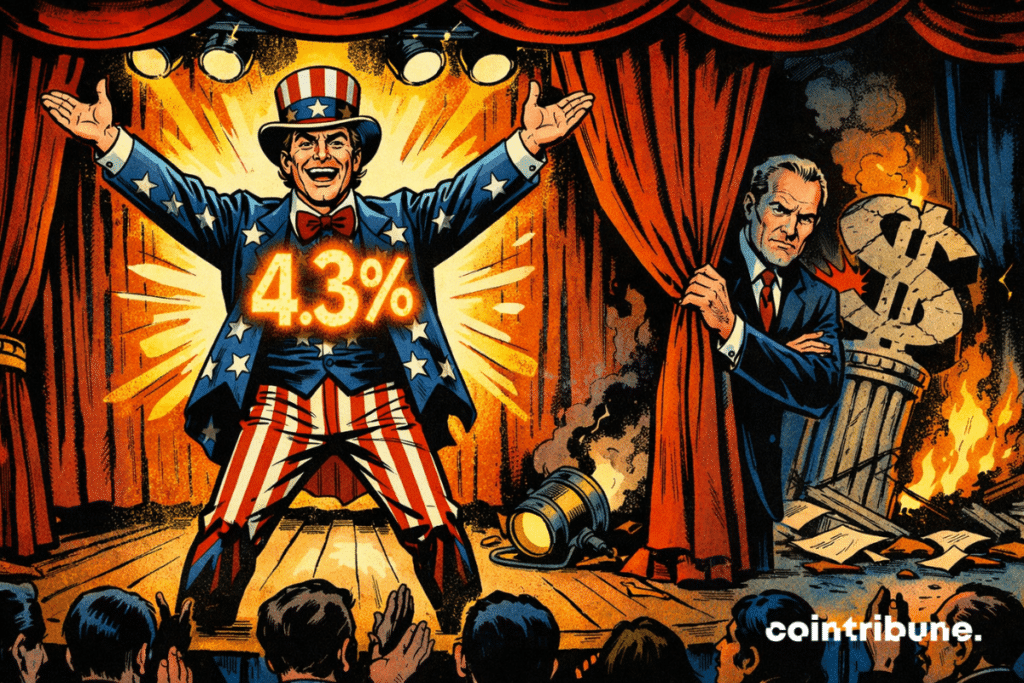

The Illusion of Strength

Surface-level metrics paint a picture of resilience. Analysts point to bullish reports and rising indices as proof of a robust system. But this narrative ignores the structural rot—the kind that doesn't show up in a quarterly report until it's too late.

Schiff's Warning: The Flaw in the Machine

Peter Schiff bypasses the headline euphoria to target the core vulnerability. He argues the celebrated growth is built on unsustainable debt and monetary policy—a classic setup where the 'beat' is just a prelude to a harder fall. It's the financial equivalent of a sugar rush.

Why Crypto Observers Are Watching

This isn't just a debate for traditional economists. For the digital asset space, these warnings signal potential instability in the very system cryptocurrencies were designed to challenge. When faith in central management erodes, decentralized alternatives don't just look innovative—they look essential.

The Real Test Ahead

The coming months won't test the economy's ability to beat low expectations. They'll test its ability to survive its own success—and the hidden costs of achieving it. After all, on Wall Street, today's triumph is often just tomorrow's liability with better marketing.

So the markets celebrate a win. Smart money is already looking for the exit.

Read us on Google News

Read us on Google News

In brief

- The growth of the American economy exceeds expectations, temporarily strengthening the confidence of financial markets.

- Peter Schiff warns of an illusion of stability, announcing a monetary crisis related to the dollar.

The American Economy Appears Robust

Theexceeds the expected 3.3%. It currently stands at 4.3%. This performance supports financial markets and reassures investors. A rising GDP often implies a positive dynamic for risky assets, including cryptocurrencies. The ISM index also remains above 55, reflecting a high level of economic activity.

In this context, Bitcoin reacts positively despite short-term volatility. During the bull cycles of 2017 and 2021, similar indicators preceded major crypto rallies. The logic is that a, perceived as speculative assets.

But this reassuring reading could mask a more fragile reality. High interest rates, combined with persistent inflation, put pressure on households. Some economists remind us that such a context does not exclude.

Peter Schiff Debunks the Official Economic Narrative

For him, this growth masks deep fragility. He points to. The rise in gold and silver reflects, according to him, a flight to SAFE haven assets, a sign of growing rejection of the dollar.

Schiff also highlights rising debts, dependence on foreign capital, and a weakening of domestic savings. He believes that if the supremacy and confidence in the dollar collapse, it will trigger a wave of sales on US bonds. Added to this WOULD be a spike in interest rates and a sharp drop in purchasing power.

This scenario would weigh heavily on the. The cost of credit would increase, consumption would decline, and companies would face a shock to their revenues. Crypto-assets could benefit from this loss of benchmarks, strengthening their role as an alternative to traditional systems.

The current signals thus contradict each other. While the numbers applaud growth, Schiff anticipates a DEEP crisis. The coming months will tell if the American economy stays on course or slips into uncertainty.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.