Prediction Markets Eye $300B in Volume As a Global ’Truth’ Layer Emerges

Forget the pundits—crowdsourced foresight is building a new reality.

The Wisdom of Wallets

Prediction markets are quietly assembling a global nervous system. They bypass traditional gatekeepers—media, analysts, even governments—by aggregating real money bets on future events. The collective intelligence of millions, voting with their capital, is proving startlingly accurate. It's a truth layer for the world, built not on authority, but on aligned financial incentives.

From Niche to Norm

What began as political gambling and crypto curiosity now forecasts corporate earnings, tech breakthroughs, and climate outcomes. The mechanism is brutally simple: put your money where your mouth is. Misinformation loses. Accurate foresight profits. This creates a self-correcting, real-time consensus on what's likely to happen next, cutting through the noise of speculation and spin.

The $300 Billion Horizon

The trajectory points toward a staggering $300 billion in annual trading volume. That figure isn't pulled from thin air—it's the logical endpoint as institutional capital, hedging strategies, and mainstream adoption converge. Every unresolved question, from supply chain delays to patent disputes, becomes a potential market. The old financial system loves complexity it can bill for; prediction markets prefer clarity you can bet on.

The era of trusting a single narrative is over. The future is now a tradable asset, and the crowd is writing the prospectus—one truthful prediction at a time.

The ‘Robinhood Effect’

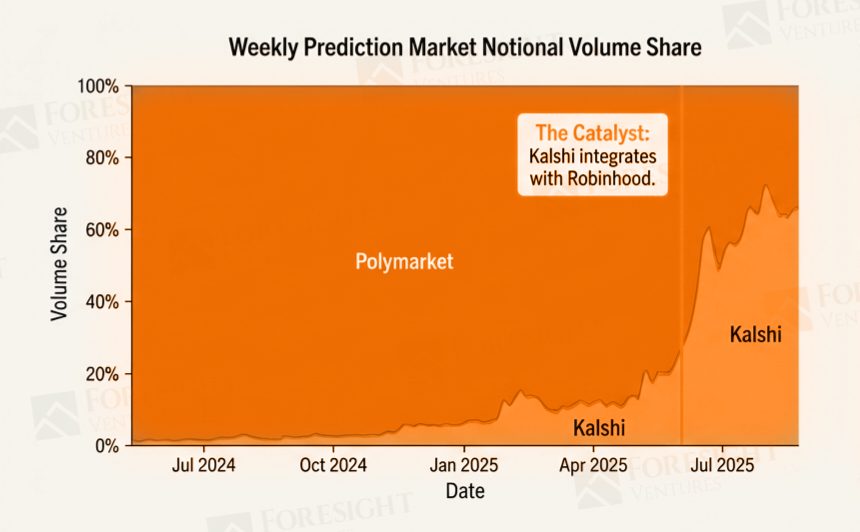

The market growth can be traced back to August, when Kalshi embedded its NFL-related event contracts – financial instruments that pay out based on the outcome of real-life events – directly into the Robinhood trading app.

Alice Li, investment partner at Foresight Ventures, told Cryptonews the deal gave Kalshi access to 27.4 million funded brokerage accounts on Robinhood, “dramatically accelerating adoption beyond traditional crypto audiences.”

She said Kalshi’s market share jumped from 8% to 66% a few months after the integration. Annualized trading volume surged 200x, from $300 million to $40–50 billion, while daily active users climbed 20-fold to about 75,000.

Li said the data shows that regulatory compliance combined with mainstream distribution can “outperform crypto-native network effects, particularly in the U.S. market.

“The Kalshi–Robinhood integration is a blueprint for what comes next. By 2026, prediction markets won’t rely on users ‘discovering’ them; they’ll be embedded where users already are: brokerages, trading apps, fintech super-apps, and potentially even media platforms.”

Kalshi operates as a federally regulated exchange under the oversight of the U.S. Commodity Futures Trading Commission, allowing it to offer event contracts across the country. Kalshi directly challenges traditional sports betting platforms that operate under state-by-state rules.

According to Li, sports contracts currently account for 70% of total volume, but the underlying mechanics are being applied to everything from Federal Reserve interest rate decisions to the success of SpaceX launches.

She expects sports-related contracts to continue to dominate as the primary onboarding mechanism for retail users through 2026.

Prediction Markets: Data Over Bets

Apart from sports and elections, experts who spoke to Cryptonews see a longer-term shift toward using prediction markets as information engines rather than pure betting venues.

Polymarket, one of the largest crypto-native platforms, is moving into an institutional data model following a reported $2 billion investment from Intercontinental Exchange (ICE), owner of the New York Stock Exchange.

The company’s real-time probability data is being explored for applications in risk modeling, sentiment analysis, and event-driven financial products, including potential integration into platforms such as Bloomberg.

“The most interesting application of prediction markets isn’t just trading on the events themselves, but rather using the probabilities they generate as an information source for trading in larger markets,” said Kaledora Kiernan Linn, co-founder and CEO of RWA platform Ostium.

Linn told Cryptonews that traders could use event probabilities the same way they use prices in traditional limit orders. “Instead of saying, ‘trade if the price hits X,’ you could say, ‘trade if the probability of this event hits X.'”

For example, a trader could set a conditional order to buy Bitcoin if, say, the probability of [Donald] Trump winning an election rises above 70%, using the market’s collective expectations as a trigger.

“That’s a conditional order based on information rather than price,” Linn said, adding:

“We believe this is one of the most powerful next steps for prediction markets: the value isn’t only in whether people trade the markets themselves, but in how the information they produce informs broader trading decisions.”

Linn noted that the plan to bring Polymarket data into Bloomberg shows that prediction market probabilities “are being recognized as high-quality signals.”

“Even more so than trading the event outcomes themselves, large institutions are interested in the information they produce. They see prediction markets as an increasingly reliable gauge of truth.”

Foresight Ventures report concludes that although the U.S. market is consolidating, global opportunities remain for platforms focused on regional content, localization, and alternative governance models.

“As prediction markets mature,” Li said, “we believe they are evolving beyond speculative tools into a new LAYER of financial and information infrastructure that reflects real-time sentiment, risk, and collective intelligence.”